A PRACTICE AID FROM BDO’S PROFESSIONAL PRACTICE GROUP

Accounting for Leases Under ASC 842

UPDATED SEPTEMBER 2021

ACCOUNTING FOR LEASES UNDER ASC 842 2

BDO Knows Identifying and Separating

Components

OVERVIEW

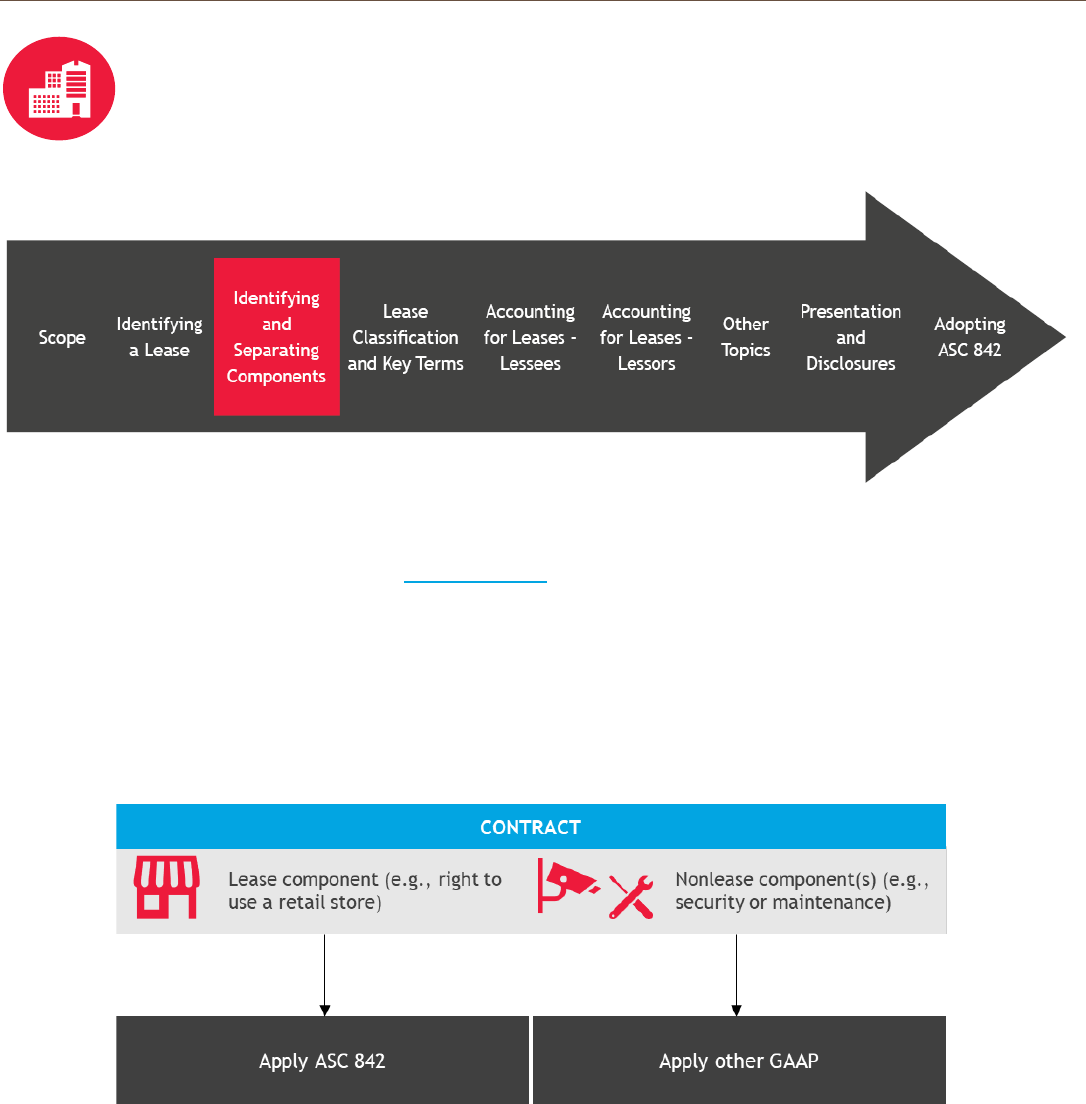

In the previous article, we discussed how to identify a lease. Once an entity concludes that a contract is or contains a

lease, the next step is to identify the components of the contract. Those components are the units of account that

determine which GAAP applies, and they only include those items or activities that transfer a good or service to the

lessee. The definition of a lease is based on the right to use an identified asset and, therefore, the lease component

typically represents the right to use that identified asset (such as the right to use a retail store). A contract may also

include one or more nonlease components (such as maintenance or security services for that retail store). In that

scenario, the lease component is accounted for under ASC 842, while the nonlease component(s) are generally

accounted for under other GAAP.

A co

ntract may also include the lease of more than one asset. In those situations, the entity should evaluate how many

lease components there are. Generally, the right to use each individual asset represents a separate lease component.

For example, in a contract for the right to use two cars, each car represents a separate lease component, and the

contract therefore includes two lease components. But sometimes leases of multiple assets are accounted for as one

lease component depending on how dependent and interrelated, they are to each other. There are also specific

considerations for leases of land.

ACCOUNTING FOR LEASES UNDER ASC 842 3

Some items or activities do not transfer a good or service to the lessee and, therefore, are not considered components

of the contract. Those include:

Administrative tasks to set up the contract,

Cost that a lessor would incur in its role as a lessor or as owner of the underlying asset (e.g., property taxes

for which the lessor is the primary obligor and insurance that protects the lessor’s asset).

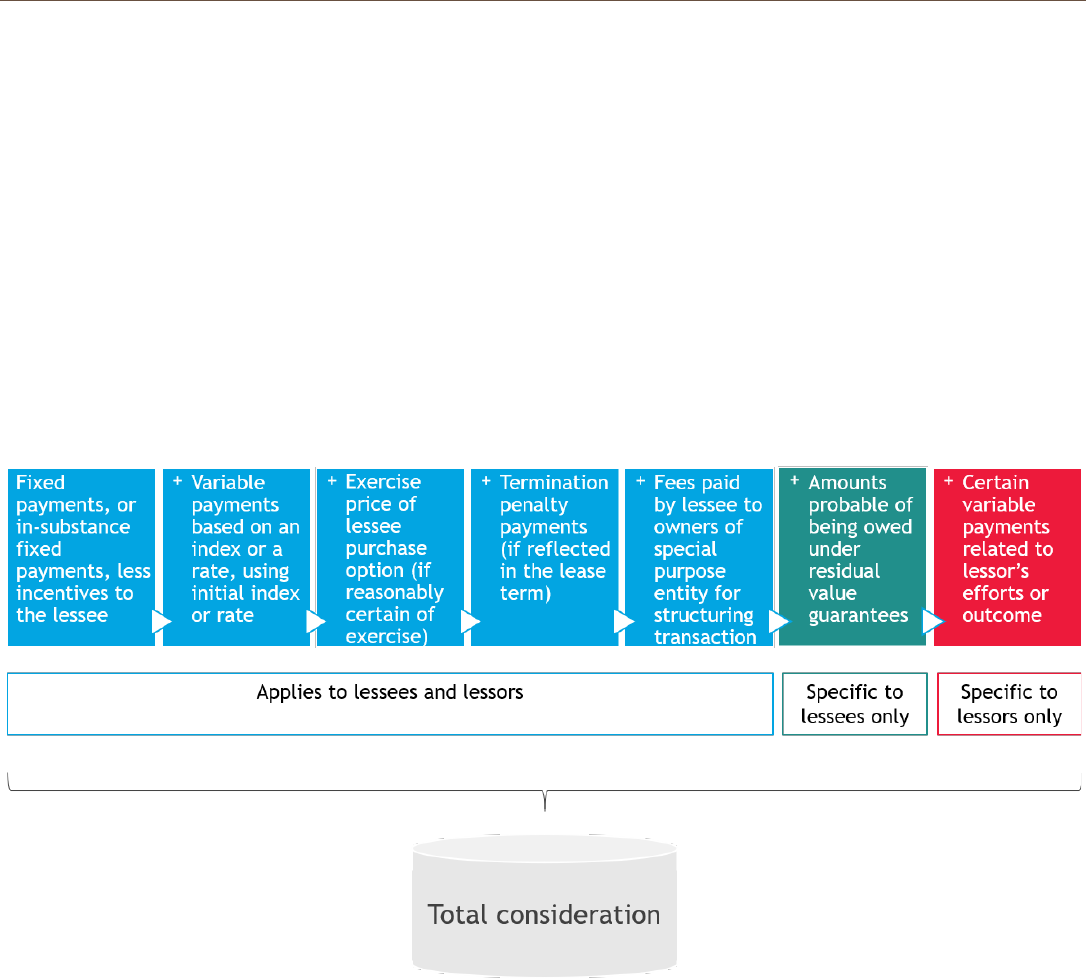

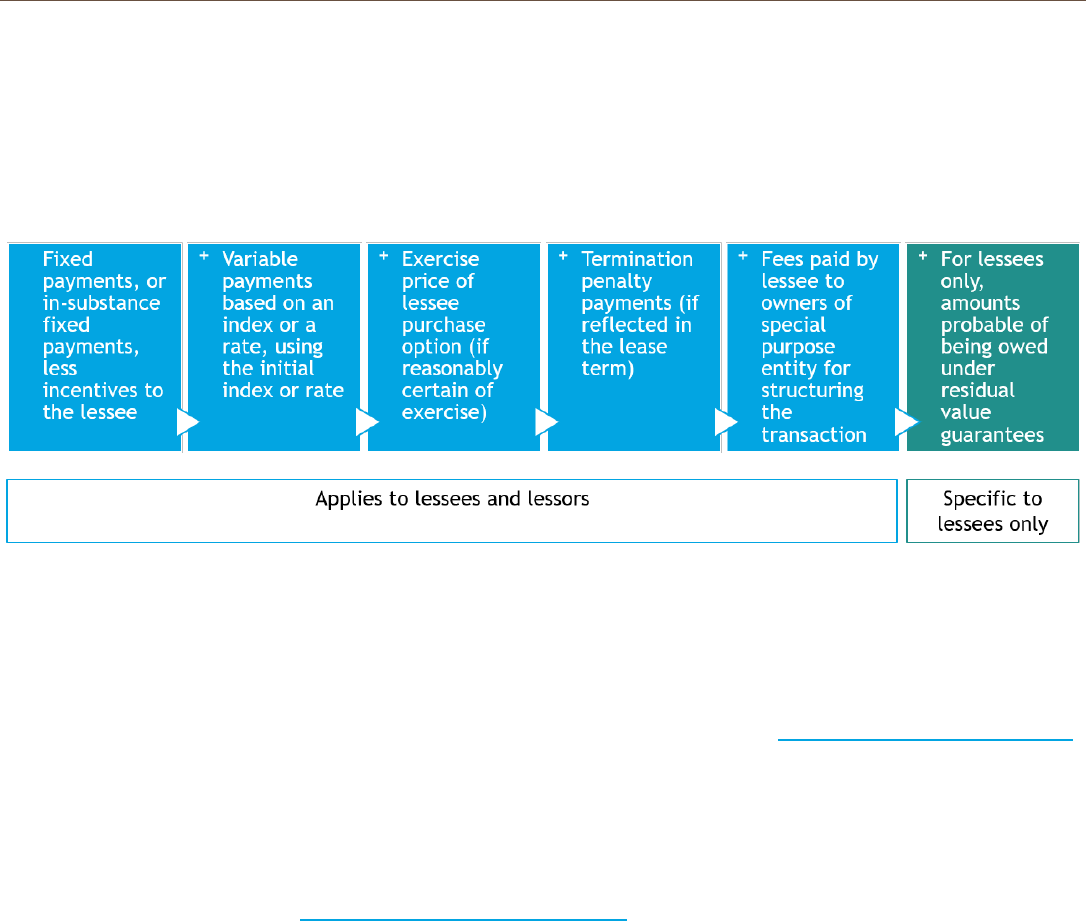

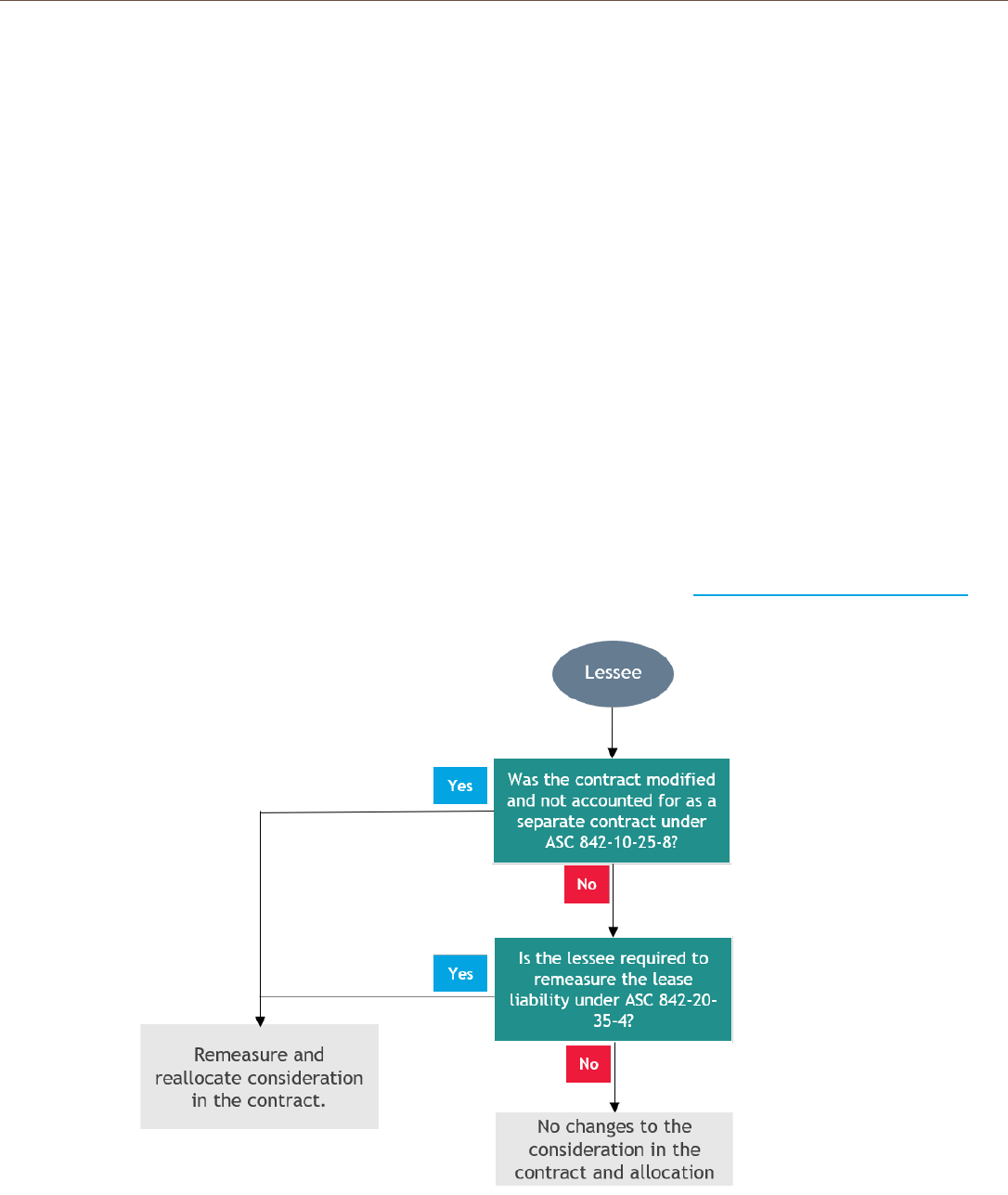

In addition to identifying the components of the contract, the entity must determine the consideration in the contract.

It typically includes fixed payments (including in-substance fixed payments) less incentives to the lessee, and variable

payments based on an index or a rate, measured using the index or rate at the commencement date. The consideration

may also include other payments depending on the contract’s terms, such as the exercise price of a lessee purchase

option if reasonably certain of exercise, or termination penalties if the lease term reflects exercise of a lessee

termination option. A lessee does not include variable payments other than those based on an index or a rate, while

lessors sometimes must include certain variable payments that relate specifically to nonlease components.

The following graph summarizes the consideration in the contract for lessees and lessors.

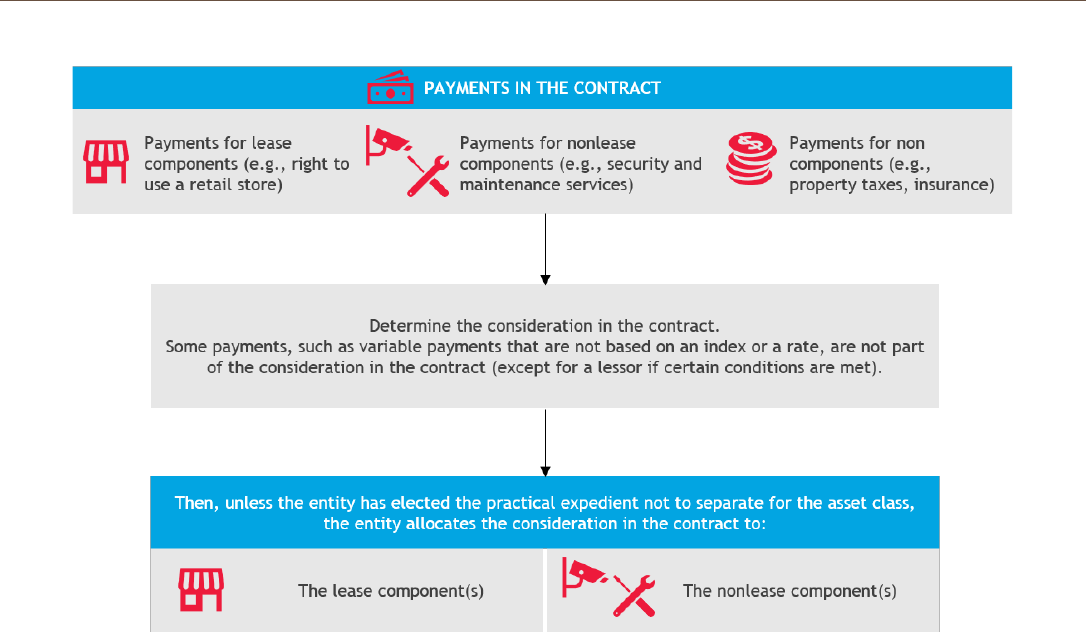

When a contract includes more than one lease component (for example, a contract with two lease components), or

includes a lease component and at least a nonlease component, the entity typically must separate and allocate the

consideration in the contract to those components, unless a practical expedient is elected (see below).

The allocation of the consideration is generally made on a relative standalone (selling) price basis, although lessors

must apply the allocation guidance in ASC 606.

Also, items or activities that do not transfer a good or service to the lessee do not receive an allocation of the

consideration in the contract because they are not considered components of the contract. This means that any

payments in the contract for these items or activities, whether fixed or variable, will generally be allocated to the

components of the contract as illustrated on the next page.

ACCOUNTING FOR LEASES UNDER ASC 842 4

However, lessees and lessors can elect a practical expedient by asset class not to separate the nonlease component(s)

from the associated lease component.

Lessees can generally apply the practical expedient without regard to conditions, and the combined component is

accounted for under ASC 842.

Lessors may account for each separate lease component and the nonlease components associated with that lease

component as a single lease component if the following three conditions are met:

The nonlease component(s) otherwise would be accounted for under ASC 606,

The timing and pattern of transfer of the lease component and nonlease component(s) associated with that

lease component are the same, and

The lease component, if accounted for separately, would be classified as an operating lease.

The accounting for the combined component then depends on which component of the contract is predominant which

will dictate whether the lessor applies ASC 842 or ASC 606.

ACCOUNTING FOR LEASES UNDER ASC 842 5

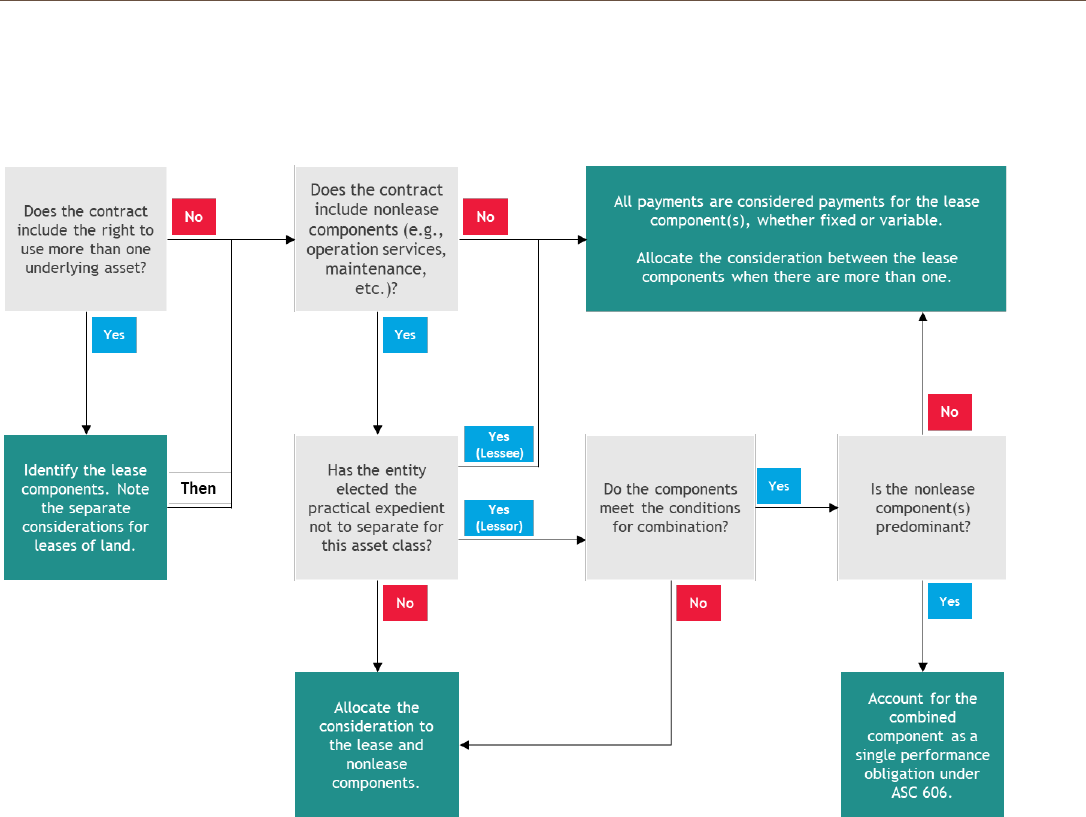

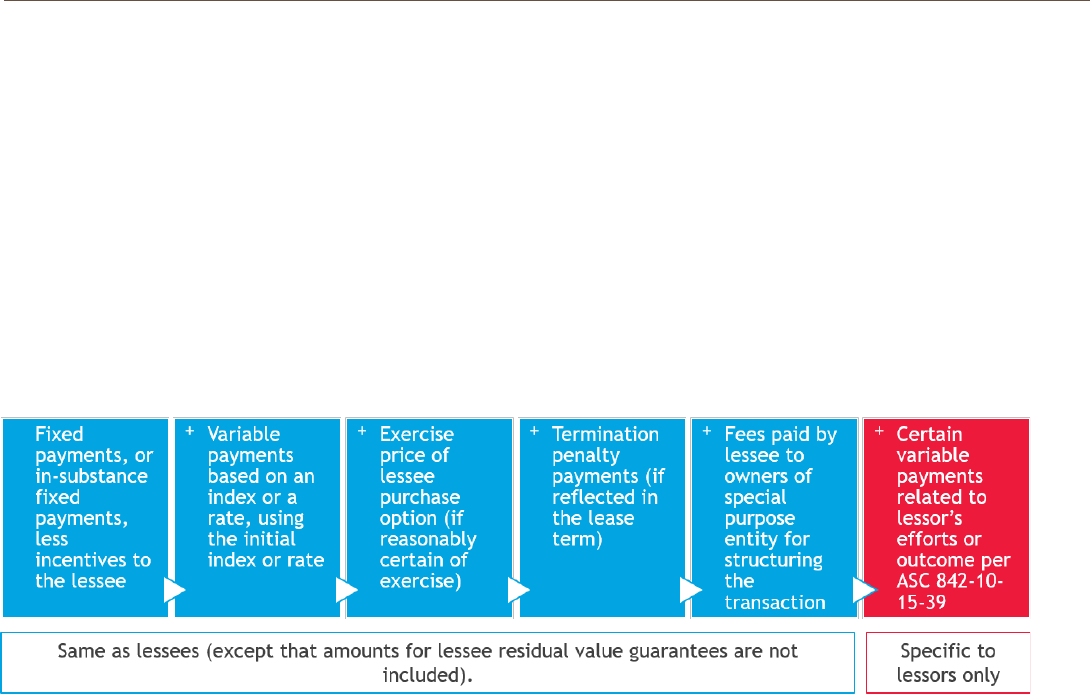

The following flowchart summarizes the key steps an entity should perform, which we will discuss in further details in

this article.

Note that the above flowchart assumes that for a lessor, the nonlease component(s) in the contract will either meet

the conditions to be combined with the lease component or won’t. Sometimes, there may be nonlease components

that meet the conditions, while some others don’t. For example, a contract may include a lease of equipment,

maintenance services related to that equipment, and a sale of consumables. In that situation, the lease component

and maintenance services may meet the criteria to be combined, but the consumables will not because they are not

provided over time. Therefore, if the lessor elected the practical expedient for the asset class, the lessor should

allocate the consideration in the contract between the combined component (the lease component and maintenance)

and the other nonlease component, which is the consumables. We will discuss this in further details in Separating

Components – Lessors section below.

ACCOUNTING FOR LEASES UNDER ASC 842 6

IDENTIFYING LEASE AND NONLEASE COMPONENTS

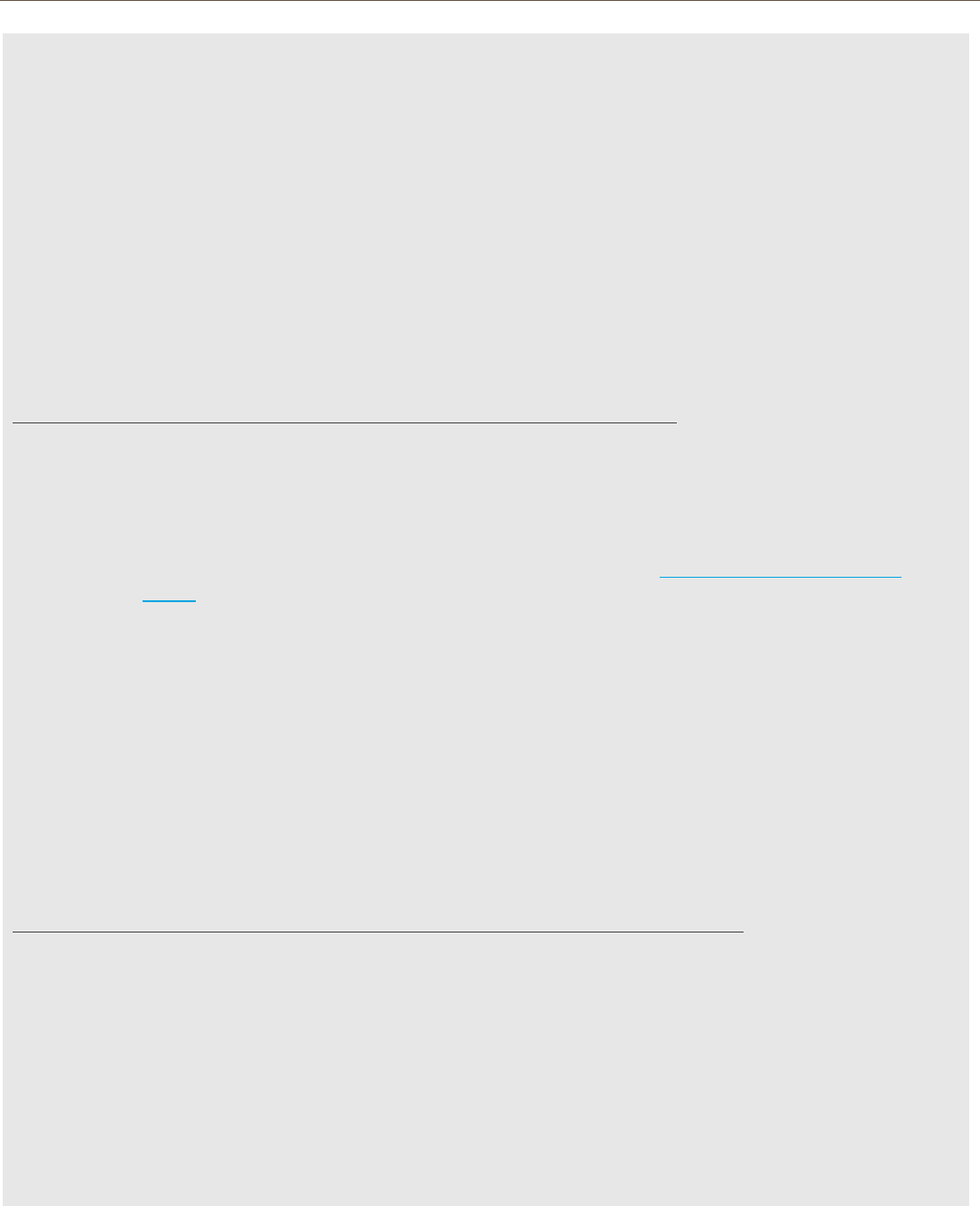

IDENTIFYING COMPONENTS OF THE CONTRACT

Components of a contract include only those items or activities that transfer a good or service to the lessee. Some

other items or activities are not components.

Lease component examples Nonlease component examples Noncomponent examples

Right to use real estate,

such as a retail store.

Right to use computer

equipment.

Right to use a vehicle, such

as a truck.

Repairs and maintenance,

common area maintenance.

Other goods or services

provided to the lessee,

such as security services,

operating the asset (e.g., a

vessel, a drilling rig), sale

of consumables, etc.

Certain administrative tasks

to initiate the contract

(e.g., set up activities).

Reimbursement of lessor

costs related to ownership

of the leased asset (such as

property taxes and

insurance that protects the

lessor’s asset).

Lessees and lessors must identify the individual lease components and nonlease components of the contract, but do not

have to separate the nonlease components from the associated lease component if a practical expedient to not

separate is elected (see discussion below).

LEASE COMPONENT SEPARATION GUIDANCE

ASC 842 provides guidance in paragraph 842-10-15-28 on identifying separate lease components:

In assessing the first condition, readily available resources are goods or services that are sold or leased

separately (by the lessor or other suppliers) or resources that the lessee already has obtained (from the

lessor or from other transactions or events). An entity may consider the following questions in determining

whether this condition is met:

•

Is the asset readily sold or leased separately by the lessor or other suppliers?

•

Could the lessee readily lease or purchase an alternative asset to use with the other leased asset?

Lessee can benefit

from right of use

either on its own

or together with

other readily

available

resources

Right of use is

neither highly

dependent nor

highly interrelated

with other leased

assets

Separate lease

component

ACCOUNTING FOR LEASES UNDER ASC 842 7

In evaluating the second condition, a lessee’s right to use an underlying asset is highly dependent on or

highly interrelated with the right to use another underlying asset if each right of use significantly affects the

other. An entity may consider the following questions in determining whether this condition is met:

•

Can the lessor fulfill each of its obligations to lease one of the underlying assets independently of its

fulfilment of the other lease obligations?

•

Would there be significant costs and time for the lessor to be able to fulfill its obligation on each

leased asset?

•

Is the lessee’s ability to derive benefits from the lease of each asset significantly affected by its

decision to lease or not lease the other asset(s) from the lessor?

Lease Component Separation Guidance Similar to Guidance in ASC 606

The guidance in paragraph 842-10-15-28 on determining whether one or more lease components should be

accounted for separately is similar to the guidance in paragraphs 606-10-25-19 through 25-21 on determining

whether a good or service promised in a revenue contract is distinct, and therefore represents a separate

performance obligation. This linkage was intentional as ASC 842 incorporates concepts from ASC 606, and therefore

paragraph 842-10-15-28 should be applied in a manner similar to application of the guidance in ASC 606.

When applying paragraph 842-10-15-28, generally the right to use an underlying asset represents a separate lease

component. For example, in a contract for the right to use two cars, each car represents a separate lease component,

and the contract therefore includes two lease components. Also, while there are several potential underlying

components that comprise each car, including the engine, seats, etc., the integral parts of the car do not meet the

criteria for treatment as separate lease components. That is, the car is the lease component.

But in some cases, the right to use multiple underlying assets will represent a single lease component. Example 13 in

ASC 842-10-55 illustrates a contract for the lease of a gas-fired turbine plant that consists of the turbine housed within

a building together with the land on which the building sits. In that example, the rights to use the turbine, the

building, and the land are highly interrelated because each is an input to the customized combined item for which the

lessee contracted (i.e, the right to use a gas-fired turbine plant that can produce electricity for distribution to the

lessee’s customers). Accordingly, they represent a single lease component (absent additional considerations for land –

see below). However, the fact that a lessee will use multiple underlying assets for one purpose is not sufficient to

conclude that the rights of use are highly interrelated or interdependent of each other. The FASB illustrated this in

Example 11 of ASC 842-10-55. We also illustrate it in the following examples.

ACCOUNTING FOR LEASES UNDER ASC 842 8

Example 1 - Lease of Helicopter and Jet

FACTS

Lessee enters into a lease of a helicopter and a private jet from Lessor for two years for its key

executives in the company for a specific project requiring significant travel.

Lessor agrees to maintain the helicopter and the jet throughout the contract term.

ANALYSIS

Lessee can benefit from each of the two assets on its own or together with other readily available

resources. For example, Lessee could readily lease or purchase an alternative helicopter or jet to use

with the other asset.

Although Lessee is leasing the helicopter and jet for one purpose (key executives’ travel related to a

specific project), the helicopter and jet are not highly dependent nor highly interrelated with each other.

The two assets are not, in effect, inputs to a combined item for which Lessee is contracting. Lessor can

fulfill each of its obligations to lease one of the underlying assets independently of its fulfillment of the

other lease obligation, and Lessee’s ability to derive benefits from the lease of each asset is not

significantly affected by its decision to lease or not lease the other equipment from Lessor.

The maintenance services represent nonlease components because they provide Lessee with goods or

services separate from the lease of the jet and helicopter. Also, Lessor determines under ASC 606 that its

maintenance services for each piece of leased equipment are distinct and therefore are separate

performance obligations.

CONCLUSION

There are two separate lease components and two separate nonlease components, unless the entity elects the

practical expedient not to separate for this asset class, in which case:

For Lessee, the contract has two separate lease components under ASC 842 (see Separating Components –

Lessee section for additional details),

For Lessor, the contract has either two separate lease components under ASC 842 or two separate

performance obligations under ASC 606 depending on predominance (see Separating Components – Lessor

section for additional details).

ACCOUNTING FOR LEASES UNDER ASC 842 9

Example 2 - Lease of Air Purification System

FACTS

Clean Air Co. provides air purification systems, primarily to hospitals and other healthcare facilities,

under leasing arrangements.

Each system consists of multiple air filters and related equipment installed throughout the lessee’s

facility, in an amount and at locations determined based on the size and design of the facility.

Lessee enters into a contract with Clean Air Co. for an air purification system that can filter the air at

Lessee’s healthcare facility and for maintenance of the system.

Assume the contract contains a lease.

ANALYSIS

Because of airflow throughout Lessee’s facility, any individual air filter is ineffective on its own.

Achieving air purification requires the full complement of air filters and related equipment provided in

the arrangement.

Therefore, the use of each air filter and related equipment used for the air purification system is highly

dependent on the use of the other air filters and equipment. Each is an input to the customized combined

item for which Lessee has contracted (that is, the right to use an air purification system that can filter

the air at Lessee’s healthcare facility).

The maintenance services represent a nonlease component because they provide Lessee with goods or

services separate from the lease. Also, Clean Air Co. determines under ASC 606 that its maintenance

services represent a single performance obligation.

CONCLUSION

The contract contains one lease component (the right to use the air purification system) and one nonlease

component (maintenance of the system), unless the entity elects the practical expedient not to separate for this

asset class, in which case:

For Lessee, the contract has one lease component under ASC 842 (see Separating Components – Lessee

section for additional details).

For Lessor, the contract has either one lease component under ASC 842 or one performance obligation

under ASC 606 depending on predominance (see Separating Components – Lessor section for additional

details).

ACCOUNTING FOR LEASES UNDER ASC 842 10

Example 3 - Lease of Light Fixtures

FACTS

Lighting Co. provides energy-efficient light fixtures, primarily in industrial settings, under leasing

arrangements. Payments under the leasing arrangements are based on calculated cost savings to lessees.

Each arrangement consists of multiple light fixtures installed throughout the lessee’s facility, in an

amount and at locations determined based on the size and design of the facility.

Lessee enters into a contract with Lighting Co. for energy-efficient light fixtures.

Assume the contract meets the definition of a lease.

ANALYSIS

Lessee can benefit from each of the light fixtures on its own or together with other readily available

resources. For example, Lessee could readily lease or purchase alternative light fixtures.

The purpose of the light fixtures is to provide a lower cost alternative to traditional lighting solutions.

However, each light fixture provides a similar estimated cost saving and would provide the same level of

cost savings regardless of whether each light fixture was installed on its own, or as part of a larger

installation. Therefore, the right to use each light fixture is neither highly dependent on nor highly

interrelated with the use of the other light fixtures.

CONCLUSION

The contract contains multiple lease components; that is, each light fixture is a separate lease

component.

Lessee and Lighting Co cannot apply the practical expedient not to separate to this contract because

there are no nonlease components in the contract. However, the entity may consider applying a portfolio

approach (see Portfolio Approach section).

ACCOUNTING FOR LEASES UNDER ASC 842 11

SPECIFIC CONSIDERATIONS FOR LAND

Irrespective of the guidance discussed above on separating lease components, ASC 842 requires a lease of land to be

accounted for as a separate lease component unless the accounting effects of such separation would be insignificant.

Paragraph 842-10-15-29 discusses two examples in which the accounting effect is insignificant:

Separating the land component would not affect lease classification of any lease components,

The amount recognized for the land lease component would be insignificant.

The Board noted in paragraph BC147 of ASU 2016-02 that “land, by virtue of its indefinite economic life and

nondepreciable nature, is different from other assets, such that it should be assessed separately from other assets

regardless of whether the separating lease components criteria are met.”

Identifying Leases of Land

Determining whether a contract includes a lease of land will depend on the facts and circumstances. In some cases,

the analysis will be straightforward. For example, a contract for a lessee to lease an entire office building will

include a lease of land on which the building sits, regardless of whether such lease of land is explicitly stated in the

contract, because the lessee is leasing the entire building and therefore also exclusively benefits from the use of

the land. In other cases, further analysis may be required. For example, in a contract for a lessee to lease retail

space in a shopping mall, the analysis may depend on whether the lessee is the anchor tenant (and whether that

anchor tenant occupies substantially all the shopping mall space), or another tenant that leases a smaller space

(e.g., a lessee that leases a retail space on the second floor).

If it is determined that the contract includes a lease of land, the entity must account for the lease of land

separately from the lease of the other assets unless doing so would be immaterial (e.g., lease classification would

not change for either components, or the lease of land is immaterial).

ACCOUNTING FOR LEASES UNDER ASC 842 12

Example 4 - Lease of Land and Building

FACTS

Lessor and Lessee enter into a five-year lease of a single-story commercial office building.

Lessee has exclusive use of the building (i.e., it is a single-tenant office building).

The contract requires Lessee to pay Lessor for real estate taxes and insurance. Lessor is the primary

obligor for the real estate taxes (regardless of whether Lessor leases the building and who the lessee is).

Lessor is also the named insured on the insurance, which protects Lessor’s investment in the building.

The lease requires Lessor to perform landscaping services for Lessee.

ANALYSIS

Regardless of whether the contract explicitly provides for the lease of land, the contract includes a lease

of land because Lessee has exclusive use of the commercial office building, and therefore also exclusively

benefits from use of the land on which the building sits.

The lease of land and building are highly dependent on or highly interrelated with each other because

each right of use significantly affects the other. However, because the contract contains a lease of land,

Lessee and Lessor must consider the guidance in paragraph 842-10-15-29. Lessor and Lessee each

conclude that the effect of accounting for the land lease component separately would be insignificant. In

this contract, Lessee’s right to use the land and building is coterminous and separating the two

components would not change lease classification of either the land or building lease component.

The real estate taxes and insurance on the building are not considered components of the contract

because they are considered reimbursements of Lessor’s costs for the land and building. See Separating

Components – Lessee section and Separating Components – Lessor section for additional considerations on

taxes and insurance.

Finally, the landscaping services is a nonlease component because it transfers a good or service to Lessee

separate from the lease of land and building. Lessor also determines under ASC 606 that the landscaping

nonlease component represents a single performance obligation.

CONCLUSION

The contract includes two components: a single lease component (comprising the right to use the land

and building), and a nonlease component (landscaping services), unless the entity elects the practical

expedient not to separate for this asset class.

See Separating Components – Lessee section for additional guidance on accounting for the components

and Example 4A for a continuation of this Example for Lessee.

See Separating Components – Lessor section for additional guidance on accounting for the components

and Example 4B for a continuation of this Example for Lessor.

ACCOUNTING FOR LEASES UNDER ASC 842 13

Example 5 - Lease of Office Space

FACTS

Lessor and Lessee enter into a five-year lease for one floor in a 30-story office building in New York City.

Lessee has exclusive use of the floor.

The lease requires Lessor to perform common area maintenance (CAM) services.

The contract requires Lessee to reimburse Lessor for its pro-rata share of real estate taxes and insurance

incurred by Lessor on the building, and CAM charges. The CAM charges can be adjusted upward and

downward based on actual work performed by Lessor.

ANALYSIS

The contract does not include a lease of land because Lessee does not occupy substantially all of the

building (i.e., the land on which the building sits is shared by all of the tenants in the building).

The real estate taxes and insurance Lessee will pay to Lessor are not considered components of the

contract because they are considered reimbursements of Lessor’s costs for the building. See Separating

Components – Lessee section and Separating Components – Lessor section for additional considerations on

taxes and insurance.

The common area maintenance service is a nonlease component because it transfers a good or service to

Lessee separate from the lease of the floor. Lessor also determines under ASC 606 that the common area

maintenance represents a single performance obligation.

CONCLUSION

The contract includes two components: one lease component and one nonlease component (common area

maintenance services), unless the entity elects the practical expedient not to separate.

See Separating Components – Lessee section for additional guidance on accounting for the components

and Example 5A for a continuation of this Example for Lessee.

See Separating Components – Lessor section for additional guidance on accounting for the components

and Examples 5B and 5C for a continuation of this Example for Lessor.

ACCOUNTING FOR LEASES UNDER ASC 842 14

SEPARATING COMPONENTS - LESSEES

DETERMINING THE CONSIDERATION IN THE CONTRACT

The consideration in the contract for a lessee is determined by applying paragraphs 842-10-15-35 and 842-10-30-5 and

includes the following payments that will be made during the lease term:

For a lessee, the sum of the above payments represents the total consideration in the contract, which the lessee

allocates to the separate lease and nonlease components of the contract, unless the lessee elects the practical

expedient to not separate for this asset class (see discussion below).

Variable payments that depend on an index or a rate are initially measured using the index or rate at the

commencement date. Subsequent changes to the index or rate during the lease term are accounted for as variable

payments, unless the lessee is required to remeasure the lease for other reasons (see Accounting for Leases – Lessees

for details).

Variable payments that do not depend on an index or a rate are not included in the determination of the total

consideration in the contract. This includes variable payments based on the performance of the asset, such as

payments based on a percentage of sales of the lessee, or reimbursement of actual costs incurred by the lessor (such as

property taxes and insurance).

The next article in this series on Lease Classification and Key Terms

discusses further details in-substance fixed

payments, lease incentives, purchase options and termination options.

ACCOUNTING FOR LEASES UNDER ASC 842 15

PROPERTY TAXES AND INSURANCE CONSIDERATIONS

A lessee’s requirement to pay costs that the lessor may incur in its role as a lessor or as owner of the underlying asset

do not transfer a good or service to the lessee separate from the lease. Example 12, Case A of ASC 842-10-55 provides

an example of a real estate lease and explains that:

The property taxes on the building would be owed by the lessor regardless of whether it leased the building

and who the lessee is; and

For the insurance, the lessor is the named insured on the building insurance policy and therefore the

insurance protects the lessor’s investment in the building.

Accordingly, the lessee paying those costs solely represents a reimbursement of the lessor’s costs. The fact that the

lessee pays a third-party, including the taxing authority, rather than reimbursing the lessor does not change this

conclusion. Also, the classification of a lease (e.g., as operating versus finance lease for the lessee) does not affect the

analysis of whether costs are considered lessor costs or lessee costs.

The accounting by a lessee for reimbursement of lessor costs depends on whether the payments are fixed or variable.

Payments are fixed Payments are variable

Payments are included in the consideration in the

contract, which is allocated to the lease and nonlease

components in the contract on a relative standalone

price basis, unless the lessee elects the practical

expedient not to separate for the asset class. Those

payment amounts (or a portion of those if there are

nonlease components) will affect the measurement of

the lease on balance sheet.

Payments do not represent variable payments based on

an index or a rate and, therefore, are not included in

the consideration in the contract. Once the variable

payments are incurred, they will be allocated between

the lease and nonlease components using the same

allocation as at contract’s inception, or most recent

reallocation.

Example: Lessee is required to pay lessor a fixed

amount per year for insurance coverage on the leased

asset.

Example: Lessee is required to reimburse lessor for

actual property taxes due on the asset under lease.

Property taxes do not represent an index or a rate, and

therefore are considered variable payments.

In some cases, there may be additional complexity in differentiating between lessee costs and lessor costs, particularly

for insurance contracts for which there may be elements benefitting the lessor (e.g., protecting the leased asset) and

others benefitting the lessee (e.g., protecting the lessee’s owned assets or other contingencies). In those situations,

additional analysis may be required to determine the portion of the payments that represent lessor costs (i.e., portion

of the premium that protects the lessor’s asset). Amounts that are considered lessee costs (i.e., portion of the

premium protecting the lessee’s assets) do not affect the accounting for the lease.

ACCOUNTING FOR LEASES UNDER ASC 842 16

SALES TAXES AND SIMILAR TAXES

When an entity enters into a lease, taxes may be assessed on the contract by a governmental authority. Those taxes

may be both imposed on and concurrent with a specific lease revenue-producing transaction and collected by the

lessor from a lessee. This includes for example sales, use, value added, and some excise taxes. Unlike lessors (see

Separating Components – Lessor section), lessees do not have a practical expedient to not assess such taxes.

Accordingly, a lessee is required to analyze sales taxes and other similar taxes on a jurisdiction-by-jurisdiction basis to

determine whether those taxes are the primary obligation of the lessor as owner of the underlying asset being leased

(i.e., the tax is a lessor cost) or whether those taxes are collected by the lessor on behalf of third parties (i.e., the tax

is a lessee cost).

If a lessor cost, the tax is accounted for either as part of the consideration in the contract (if the payments

are fixed) or as variable payments that do not depend on an index or a rate.

If a lessee cost, the tax typically does not impact lease accounting for the contract.

Like property taxes and insurance discussed above, the fact that the lessee pays a third-party directly rather than

reimbursing the lessor for the tax does not impact this conclusion.

PRACTICAL EXPEDIENT NOT TO SEPARATE

A lessee may elect as an accounting policy election by asset class, to not separate nonlease components from lease

components and instead, to account for each separate lease component and nonlease components associated with that

lease component as a single lease component.

The FASB provided this practical expedient to reduce cost and complexity in applying ASC 842. However, the election

of the practical expedient results in a larger right-of-use asset and lease liability on balance sheet, and it may also

change classification from an operating to a finance lease (See article 4 on Lease Classification and Key Terms

).

Accordingly, companies will need to consider the pros (e.g., simplicity) and cons (e.g., impact on accounting for the

lease, including balance sheet) of electing the practical expedient for their asset classes.

Nonlease Components “associated with” the Lease Component

ASC 842 does not define or provide guidance for determining whether a nonlease component is “associated with”

the lease component. A literal read of the requirements for the practical expedient may suggest that all nonlease

components, whether provided at a point in time or over time, that are associated with the lease component should

be combined with that lease component when the lessee elects the practical expedient. However, we note that ASC

842 illustrates in Example 11 of ASC 842-10-55 the application of the practical expedient to a contract in which the

nonlease component is maintenance services on construction vehicles. Paragraph BC 149 of ASU 2016-02 also notes

that “[t]he Board also decided that lessees should account for lease and nonlease (typically, service) components

separately (unless they elect the practical expedient) [Emphasis added].” Accordingly, we believe the practical

expedient to not separate was primarily intended for services and other nonlease components transferred over time

and that relate to the lease component (e.g., maintenance of a leased equipment, common area maintenance for a

lease of office space). For nonlease components provided at a point in time such as inventory purchases, we believe

a lessee will frequently conclude that the component is not associated with the lease component because the

lessee usually will be able to redirect the inventory and use it with a different asset, or to resell it in the market.

ALLOCATION OF CONSIDERATION TO LEASE AND NONLEASE COMPONENTS

If a lessee does not elect the practical expedient not to separate for an asset class, once the consideration in the

contract is determined and the components are identified, a lessee allocates the consideration to the lease and

nonlease components on a relative standalone price basis, based on the observable standalone price of each

component. A price is observable if it is the price at which either the lessor or similar suppliers sell similar lease or

nonlease components on a standalone basis.

ACCOUNTING FOR LEASES UNDER ASC 842 17

If observable standalone prices are not readily available, a lessee must estimate standalone prices maximizing the use

of observable information. A residual approach may be acceptable if the standalone price for a component is highly

variable or uncertain.

Paragraph BC156 in ASU 2016-02 states in part that “the allocation guidance for lessees is similar to that for lessors and

also is broadly consistent with that in previous GAAP.”

A lessee also allocates initial direct costs to the separate lease components on the same basis as the lease payments.

Example 6 – Lease of a Car

FACTS

Lessee leases a car for its salesperson from Dealership for three years.

Lessee has the right to drive the car for up to 15,000 miles per calendar year and to bring the car into the

maintenance department of Dealership once per quarter for regularly scheduled maintenance as defined

in the lease agreement.

The contract provides for a fixed payment of $415 per month.

Lessee is required to maintain full coverage insurance on the car to protect Dealership’s asset. Lessee

must contract directly with an insurance agency of its choice.

Lessee is required to pay for any maintenance services required beyond regularly scheduled maintenance

defined in the contract.

At the end of the lease term, Lessee is required to make additional fixed payments on a per mile basis for

any mileage greater than 45,000 miles.

Assume there are no lease incentives or initial direct costs.

WHAT ARE THE COMPONENTS?

The contract contains two components: a lease component (lease of the car) and a nonlease component

(maintenance services). The insurance coverage is not a component. It does not transfer a good or

service separate from the lease of the car (it represents a lessor cost of owning the asset).

However, Lessee may elect to apply the practical expedient not to separate for this asset class, in which

case the contract would contain a single lease component.

WHAT IS THE CONSIDERATION IN THE CONTRACT?

The contract includes a fixed monthly payment of $415, payments for insurance (paid by Lessee directly

to the insurance company of its choice), payments for excess mileage at the end of the lease term, and

payments for extra maintenance.

Only the fixed monthly payment of $415 is included in the consideration in the contract. The other

payments are variable payments that do not depend on an index or a rate.

The consideration in the contract is $14,940 ($415 x 36 months).

ACCOUNTING FOR LEASES UNDER ASC 842 18

WHAT ARE THE AMOUNTS ALLOCATED TO THE LEASE COMPONENT?

SCENARIO 1: Lessee elects practical expedient not to separate for this asset class.

In that situation, the contract includes only one component (i.e., the lease component).

The consideration in the contract of $14,940 is allocated entirely to the lease component and is used to

account for the lease (e.g., assess lease classification, recognize the lease on balance sheet, etc.).

All variable payments (for insurance, excess mileage and extra maintenance, if any) are considered

variable lease payments, which will be recognized in the period in which the obligation for those

payments is incurred. Lessee will also consider the guidance in paragraph 842-20-55-1 for variable

payments based on the attainment of 45,000 miles.

SCENARIO 2: Lessee does not elect practical expedient not to separate for this asset class.

In that case, Lessee allocates the consideration in the contract to the lease and maintenance components

on a relative standalone price basis. Lessee identifies observable standalone prices for the vehicle lease

and maintenance services. Lessee determines that it could enter into a maintenance agreement with an

unrelated service center for $30 per month, and Dealership commonly leases the same car on a

standalone basis for $400 per month. Therefore, the consideration in the contract is allocated to the

lease and non-lease components as follows:

Standalone Price

Relative

Standalone Price

Car lease

$14,400

$13,898 (93.02%)

Maintenance

1,080

1,042 (

6.98%)

$15,480

$14,940

The amount of the consideration allocated to the lease component ($13,898) is used to account for the

lease component (e.g., assess lease classification, recognize the lease on balance sheet, etc.).

The amount of consideration for the maintenance component ($1,042) is accounted for under other

GAAP.

All variable payments for insurance, excess mileage and extra maintenance will be allocated when

incurred using the same allocation basis as for the consideration in the contract (i.e., on a 93.02%/6.98%

basis).

ACCOUNTING FOR LEASES UNDER ASC 842 19

Example 4A - Lease of Land and Building (Continued) – Lessee Accounting

FACTS

Let’s continue with Example 4 in which Lessor and Lessee enter into a five-year lease of a single-story

commercial office building.

Lessee has exclusive use of the building (i.e., it is a single-tenant office building).

The lease requires Lessor to perform landscaping services for Lessee.

Lessee pays a fixed monthly payment of $12,000 per month in arrears which includes rent, landscaping

services, and reimbursement of Lessor’s costs.

Assume there are no lease incentives or initial direct costs.

WHAT ARE THE COMPONENTS?

As previously evaluated, the contract includes two components: a single lease component (comprising

the right to use the land and building), and a nonlease component (landscaping services).

However, Lessee may elect to apply the practical expedient not to separate for this asset class, in which

case the contract would contain a single lease component.

WHAT IS THE CONSIDERATION IN THE CONTRACT?

The consideration in the contract is $12,000 X 12 months X 5years = $720,000

WHAT ARE THE AMOUNTS ALLOCATED TO THE LEASE COMPONENT?

SCENARIO 1: Lessee elects practical expedient not to separate for this asset class.

In that situation, the contract includes a single lease component.

The consideration in the contract of $720,000 is allocated entirely to the lease component and is used to

account for the lease (e.g., assess lease classification, recognize the lease on balance sheet, etc.).

SCENARIO 2: Lessee does not elect practical expedient not to separate for this asset class.

In that case, Lessee allocates the consideration in the contract to the lease component and landscaping

services component on a relative standalone price basis. Lessee determines the standalone prices for the

lease component and nonlease component are $680,000 and $50,000, respectively. Therefore, the

consideration in the contract is allocated to the lease and non-lease components as follows:

Standalone Price

Relative

Standalone Price

Lease component

$680,000

$670,685 (93.15%)

Maintenance component

50,000

49,315 (

6.85%)

$730,000

$720,000

The amount of the consideration in the contract allocated to the lease component ($670,685) is used to

account for the lease component (e.g., assess lease classification, recognize the lease on balance sheet,

etc.). The amount of consideration for the maintenance component ($49,315) is accounted for under

other GAAP.

ACCOUNTING FOR LEASES UNDER ASC 842 20

Example 5A - Lease of Office Space (Continued) – Lessee Accounting

FACTS

Let’s continue Example 5 in which Lessor and Lessee enter into a five-year lease for one floor in a 30-

story office building in New York City.

The lease requires Lessor to perform common area maintenance (CAM) services.

The contract requires Lessee to pay rent of $50,000 per month in arrears and to reimburse Lessor for

Lessee’s pro-rata share of real estate taxes and insurance incurred by Lessor on the building, and CAM

charges.

The pro rata share of those reimbursements is initially estimated at $9,000 per month ($5,000 for taxes

and insurance and $4,000 for CAM). The CAM charges can be adjusted upward and downward based on

actual work performed by Lessor.

Assume there are no lease incentives or initial direct costs.

WHAT ARE THE COMPONENTS?

As previously evaluated, the contract includes two components: one lease component (lease of the floor)

and one nonlease component (CAM services).

However, Lessee may elect to apply the practical expedient not to separate for this asset class, in which

case the contract would contain a single lease component.

WHAT IS THE CONSIDERATION IN THE CONTRACT?

The consideration in the contract is $50,000 X 12 months X 5years = $3,000,000.

The other payments Lessee will make to Lessor for its prorata share of real estate taxes, insurance and

CAM are variable payments that do not depend on an index or a rate. Therefore, they are not included in

the consideration in the contract.

WHAT ARE THE AMOUNTS ALLOCATED TO THE LEASE COMPONENT?

SCENARIO 1: Lessee elects practical expedient not to separate for this asset class.

In that situation, the contract includes only one component (i.e., the lease component).

The consideration in the contract of $3,000,000 is allocated entirely to the lease component and is used

to account for the lease (e.g., assess lease classification, recognize the lease on balance sheet, etc.).

Lessee’s payments for its prorata share of property taxes, insurance and CAM are variable lease payments

that do not depend on an index or a rate and are excluded from the measurement of the lease liability.

Those variable lease payments are recognized in profit or loss when incurred.

ACCOUNTING FOR LEASES UNDER ASC 842 21

SCENARIO 2: Lessee does not elect practical expedient not to separate for this asset class.

In that case, Lessee allocates the consideration in the contract to the lease and CAM components on a

relative standalone price basis. Lessee determines the standalone prices for the lease component and

CAM component are $3,270,000 and $270,000, respectively. Therefore, the consideration in the contract

is allocated to the lease and non-lease components as follows:

Standalone Price

Relative

Standalone Price

Lease component

$3,270,000

$2,771,186 (92.37%)

CAM component

(1)

270,000

228,814 ( 7.63%)

$3,540,000

$3,000,000

(1)

Includes an appropriate profit margin

The amount of the consideration allocated to the lease component ($2,771,186) is used to account for the

lease component (e.g., assess lease classification, recognize the lease on balance sheet, etc.).

The amount of consideration allocated to CAM services ($228,814) is accounted for under other GAAP.

All variable payments for Lessee’s prorata share of real estate taxes, insurance, and CAM are allocated

using the same allocation basis as for the consideration in the contract (i.e., on a 92.37%/7.63% basis).

In the prior example, it is important to note that if the practical expedient not to separate is not elected, the variable

payments must be allocated between the lease and nonlease components despite the fact that the lease clearly

provides for specific charges related to the nonlease services, i.e. CAM. This is because a lessee is not allowed to

allocate variable consideration solely to the nonlease component, as lessors are allowed to.

APPLYING THE RESIDUAL APPROACH

In accordance with paragraph 842-10-15-33, if a lessee has elected to separate lease and non-lease components, then

it must allocate the consideration in the contract between the lease component(s) and the non-lease component(s) on

a relative standalone price basis. The guidance further states that “if observable standalone prices are not readily

available, the lessee shall estimate the standalone prices, maximizing the use of observable information.” The

guidance also indicates that “a residual estimation approach may be appropriate if the standalone price for a

component is highly variable or uncertain.”

Paragraph BC156 of ASU 2016-02 states in part that “the allocation guidance for lessees is similar to that for lessors and

also is broadly consistent with that in previous GAAP.” Lessors apply the allocation requirements in ASC 606, including

paragraph 606-10-32-34, which provides the guidance on the suitable methods for estimating the standalone selling

prices (including a residual approach). In accordance with paragraph 606-10-32-34(c), under the residual approach an

“entity may estimate the standalone selling price by reference to the total transaction price less the sum of the

observable standalone selling prices of other goods or services promised in the contract. [Emphasis added]” However,

the following criteria must also be met in order to use the residual approach:

The entity sells the same good or service to different customers (at or near the same time) for a broad range

of amounts (that is, the selling price is highly variable because a representative standalone selling price is

not discernible from past transactions or other observable evidence); or

The entity has not yet established a price for that good or service and the good or service has not previously

been sold on a standalone basis (that is, the selling price is uncertain).

ACCOUNTING FOR LEASES UNDER ASC 842 22

As suggested by the guidance above, a lessee must have observable standalone prices for at least some of the

components in the contract to apply the residual approach. In other words, if the lessee does not have observable

standalone prices for any of the components, it must estimate the standalone price for all components. That is, the

lessee cannot use the residual approach.

In addition, in order for a lessee to meet the additional criteria and thus use the residual approach in a lease, the

entity i) would need to lease similar assets (for example, similar asset types and in a similar location) for a very broad

range of amounts indicating a representative standalone price is not discernible from past transactions or ii) has not

previously leased the applicable type of assets and is unable to determine a standalone price because there are no

similar transactions that the entity can use as a benchmark. It should be noted that the criteria in paragraph 606-10-

32-34(c) are deliberately very restrictive. Consequently, although a lessee could use the residual method if the criteria

are met, it is considered very unlikely that this will occur frequently in practice.

REMEASURING AND REALLOCATING THE CONSIDERATION

Inevitably, modifications to contracts and changes in facts and circumstances may occur during the contract term.

Paragraph 842-10-15-36 requires a lessee to remeasure the consideration in the contract and to reallocate the

consideration to the components in the contract when certain events occur. Those are:

The effective date of a contract modification that is not accounted for as a separate contract per paragraph

842-10-25-8, and

Remeasurements of the lease liability, such as a remeasurement resulting from a change in the lease term or

change in assessment of a lessee purchase option, per paragraph 842-20-35-4.

Events that require remeasurement will be discussed in further detail in article 5, Accounting for Leases - Lessees.

However, a lessee’s requirement to reallocate the consideration in the contract would depend on whether it elected

the practical expedient not to separate for the relevant asset class.

ACCOUNTING FOR LEASES UNDER ASC 842 23

SEPARATING COMPONENTS - LESSORS

DETERMINING THE CONSIDERATION IN THE CONTRACT

The consideration in the contract for a lessor includes as a starting point the payments described in paragraphs 842-10-

15-35 and 842-10-30-5 (that is, the same payment amounts as those determined by the lessee, except that a lessor

does not include amounts probable of being owed under a lessee residual value guarantee).

The consideration also includes certain variable payments related to the lessor’s efforts in transferring (or an outcome

in transferring) one or more goods or services that are not leases, consistent with the guidance in ASC 606.

There are also additional considerations for sales taxes and similar taxes, and reimbursements of lessor costs which we

will discuss separately.

The following graph summarizes a lessor’s consideration in the contract.

VARIABLE PAYMENTS RELATED TO LESSOR’S EFFORTS OR OUTCOME

The consideration for a lessor includes variable payment amounts that would be included in the transaction price in

accordance with the guidance on variable consideration in ASC 606 when they relate specifically to:

the lessor’s efforts to transfer one or more goods or services that are not leases, or

an outcome from transferring one or more goods or services that are not leases.

Those amounts are included in the consideration in the contract if it is probable that a significant revenue reversal in

the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable

consideration is subsequently resolved (consistent with the constraint on variable consideration in ASC 606).

However, if the terms of a variable payment amount (other than those that depend on an index or a rate) relate to a

lease component, even partially, the lessor does not include those payments in the consideration in the contract.

Example 14 in ASC 842-10-55 illustrates this guidance to a contract for the lease of equipment that includes

maintenance for which consideration is a fixed amount plus a variable payment amount based on a minimum number of

hours that the asset operates at a specified level of productivity. In Cases B and C of that example, the variable

payment amounts for maintenance are included in the consideration in the contract because the maintenance services

on the equipment are highly specialized and no entity would expect the equipment to meet the performance metrics

without the specialized maintenance services.

In real estate scenarios, examples of variable payments that would not be included in the consideration in the contract

include variable payments of the lessor’s property taxes and insurance, or payments based on sales of the lessee. This

is because those payment amounts relate at least partially to the lease component. Example of variable payments that

would be included in the consideration in the contract include payments for common area maintenance (CAM) services

if such payments relate solely to the lessor’s efforts to provide the CAM services.

ACCOUNTING FOR LEASES UNDER ASC 842 24

However, even if variable payments relate specifically to the nonlease component(s), when a lessor elects the

practical expedient not to separate for the asset class (assuming the nonlease component qualifies for combination

with the lease component and the lease component is the predominant component), the variable payments are not

included in the consideration in the contract. This is because the lessor elected the practical expedient and the

variable payments now relate to the lease component. See further discussion below on the lessor practical expedient.

Assessment on Variable Payments by Lessor in accordance with ASC 606

The treatment of variable payments other than those based on an index or a rate is one major difference in the

determination of the consideration in the contract between lessees and lessors. Determining whether certain

variable payments relate solely to a nonlease component may require significant judgment, as may estimating the

consideration, subject to the constraint in accordance with ASC 606. Lessors that engage in transactions with

significant variable payments may consider developing a policy to assess in a consistent manner the nature of

variable payments including earning mechanisms and triggering points for payment to assess whether such

payments are solely related to a nonlease component in accordance with paragraph 842-10-15-39.

REIMBURSEMENT OF LESSOR COSTS

As previously explained, lessor costs such as property taxes on the underlying asset and insurance that protects the

lessor’s asset, are not considered a component of the contract. Absent guidance to the contrary, a lessor would be

required to report such lessor costs on a gross basis (i.e., as revenue and expenses) whether the lessee reimburses the

lessor or pays such costs on lessor’s behalf to a third-party. However, when the lessee pays a third-party directly,

lessors noted that reporting those costs in profit or loss would be costly and complex because the lessor may not have

visibility into the actual amounts paid by the lessee and therefore may need to estimate those amounts. Lessors also

questioned the usefulness of amounts reported because those often would be based on estimates that are affected by

lessee-specific factors (for example, insurance premiums paid by the lessee for a policy that protects both the lessor’s

asset and other assets that the lessee owns, amount of deductible selected by the lessee, etc.).

Accordingly, notwithstanding the guidance on variable payments discussed previously, the accounting for lessor costs is

as follows:

Lessee pays lessor costs directly to a third-party Lessor pays costs and is reimbursed by lessee

Exclude from variable payments.

In other words, treat like a lessee cost, which

does not affect the accounting for the lease.

Account for costs excluded from the consideration

in the contract as lessor costs (i.e., as variable

payments).

In other words, recognize on a gross basis.

SALES TAXES AND SIMILAR TAXES

A lessor can make an accounting policy election to exclude from the consideration in the contract and from variable

payments not included in the consideration all taxes assessed by a governmental authority that are both imposed on

and concurrent with a specific lease revenue-producing transaction and collected by the lessor from a lessee. This

includes for example sales, use, value added, and some excise taxes. Absent that practical expedient, the analysis of

sales taxes and similar taxes could be costly and complex depending on the number of jurisdictions and the variation

of, and changes in, tax laws among those jurisdictions.

This practical expedient is consistent with the practical expedient provided in ASC 606 and reduces costs and

complexity in assessing sales taxes and similar taxes. When the lessor makes the election, it should comply with the

disclosure requirements in paragraph 842-30-50-14.

However, taxes assessed on a lessor’s total gross receipts or on the lessor as owner of the underlying asset (e.g.,

property taxes – see discussion above) are excluded from the scope of this election.

ACCOUNTING FOR LEASES UNDER ASC 842 25

PRACTICAL EXPEDIENT NOT TO SEPARATE

In July 2018, the FASB issued ASU 2018-11, which provides lessors with a practical expedient similar to lessees to not

separate lease and nonlease components by asset class, if certain criteria are met.

As provided by paragraph 842-10-15-42A, a lessor may, as an accounting policy election by asset class, choose to not

separate nonlease components from lease components and, instead, to account for each separate lease component and

the nonlease components associated with that lease component as a single lease component if the following three

conditions are met:

The nonlease component(s) otherwise would be accounted for under ASC 606,

The timing and pattern of transfer of the lease component and nonlease component(s) associated with that

lease component are the same, and

The lease component, if accounted for separately, would be classified as an operating lease.

Also, in accordance with paragraph 842-10-15-42B, for arrangements that qualify for the scope of this practical

expedient, the way in which a lessor accounts for the combined component depends on predominance:

Nonlease component(s) is (are) predominant Lease component is predominant

Account for combined component as a single

performance obligation under ASC 606.

Account for the combined component as a single

lease component under ASC 842.

Use same measure of progress used in

determining whether the arrangement qualified

for the expedient (i.e., the lessor uses a straight-

line measure of progress).

Account for the lease as an operating lease.

Account for all variable payments related to any

good or service,

including the lease

, that is part

of the combined component under the variable

consideration guidance in ASC 606.

Account for all variable payments related to any

good or service that is part of the combined

component as variable

lease

payments.

In assessing predominance, a lessor should evaluate whether the lessee would be reasonably expected to ascribe more

value to the nonlease component(s) than to the lease component.

Also, when a contract includes a lease component and multiple nonlease components, some of the nonlease

components may meet the conditions to be combined with the lease component, while other nonlease components

may not (for example, a nonlease component that transfers at a point in time). In this case, this does not preclude the

lessor from applying the practical expedient to the contract. However, the lessor is required to separate and allocate

the consideration in the contract between the combined component on one hand (i.e., the lease component and

nonlease components that meet the conditions) and the nonlease components (those that do not qualify) on the other

hand.

ACCOUNTING FOR LEASES UNDER ASC 842 26

Application Considerations for Lessor Practical Expedient Not to Separate

The following considerations are important in understanding and evaluating whether a lessor qualifies for the

practical expedient:

The practical expedient applies only to nonlease components that otherwise would be accounted for

under ASC 606. It does not apply, for example, to a contract that includes a lease component and a loan

component accounted for under ASC 310 on receivables.

Determining whether the lease component would be classified as an operating lease if accounted for

separately generally should not require a detailed quantitative analysis and may often be determined

using either a reasonable qualitative assessment, or a simplified quantitative approach in which all

payments in the contract are used to perform the present value classification test (to test if the lease

would be classified as an operating lease even with all payments) in addition to assessing the other lease

classification tests. However, in certain situations, additional analysis may be required.

Because the timing and pattern of transfer of the nonlease components must be the same as the timing

and pattern of transfer of the lease, the nonlease components will generally need to be recognized on a

straight-line basis (i.e., over time, time-based) to qualify for the practical expedient (see Note 1 below).

Performance obligations satisfied over time but using a measure of progress different from a time-

elapsed measure of progress, or performance obligations satisfied at a point in time (even if satisfied

ratably throughout the lease term), do not qualify for the practical expedient (See Note 2).

A lessor should be able to reasonably determine which component is predominant (i.e., a lessor does not

have to perform a detailed quantitative analysis or theoretical allocation). We also believe entities may

use a >50% threshold in determining which component is predominant for this lessor practical expedient

as discussed by the FASB in a public Board meeting.

We believe many lessor entities (including real estate entities and cable providers, to name a few) will take

advantage of this lessor practical expedient, as it generally may enable them to account for their transactions

under ASC 842 or ASC 606 in a manner similar to how they have accounted for them in the past, and how users of

their financial statements have used the information.

Note 1: Paragraph 842-30-25-11(a) requires a lessor to recognize operating lease payments on a straight-line basis

unless another systematic and rational basis is more representative of the pattern in which the lessee benefits

from use of the underlying asset. However, in practice, it generally is infrequent for anything other than straight-

line recognition to be applied.

Note 2: It is important to note that while the pattern of transfer of the nonlease components must be the same as

the lease component, the recognition of revenue does not have to be the same. For example, if the contract

includes variable consideration, the recognition pattern under ASC 606 for the nonlease component may not be the

same as the pattern of recognition under ASC 842. The fact that the two different standards provide for

differences in the recognition of variable consideration would not preclude a lessor from electing the practical

expedient if the timing and pattern of transfer of the lease and nonlease components are the same.

ACCOUNTING FOR LEASES UNDER ASC 842 27

Applying Lessor Practical Expedient May Change Amount of Consideration in the Contract

A key consequence of the lessor practical expedient not to separate is that it may change the consideration in the

contract for a lessor when the contract includes variable payments. For example, a real estate contract may

provide for the right to use an office building along with common area maintenance (CAM) services. The contract

may stipulate that the lessee will pay a fixed payment amount per month and will reimburse the lessor for property

taxes, insurance, and CAM costs incurred by the lessor. Absent the lessor applying the practical expedient for this

asset class, the lessee’s reimbursements for CAM services would meet the conditions in paragraph 842-10-15-39 to be

included in the consideration in the contract because the payments relate specifically to the lessor’s efforts in

transferring a good or service to the lessee that is not the lease. However, when the lessor has elected and applies

the practical expedient for this asset class, the contract includes only one lease component (assuming there are no

other nonlease components in the contract that do not qualify for the practical expedient). Accordingly, variable

payments the lessee will make to the lessor under the contract are all considered to relate to the lease component

(even the payments for CAM services), and therefore no variable payment amounts will be included in the

consideration in the contract. We illustrate this in Examples 5B and 5C below.

ALLOCATION OF CONSIDERATION TO LEASE AND NONLEASE COMPONENTS

If a lessor does not elect the practical expedient not to separate, or elects it but the criteria for combination are not

met for one or more nonlease components, the lessor allocates the consideration in the contract using the revenue

guidance in paragraphs 606-10-32-28 through 32-41.

Also, as previously discussed, lessors should include in the consideration in the contract (subject to the constraint)

variable payments that relate specifically to:

The lessor’s efforts to transfer one or more goods or services that are not leases, or

An outcome from transferring one or more goods or services that are not leases.

If included in the consideration, those variable payment amounts are allocated entirely to the nonlease component(s)

to which the variable payment specifically relates if doing so would be consistent with the transaction price allocation

objective in paragraph 606-10-32-28.

However, if the terms of the variable payment amount (other than those that depend on an index or a rate) relate to a

lease component, even partially, the lessor cannot recognize those payments before the changes in facts and

circumstances on which the variable payment is based occur (for example, when the lessee’s sales on which the

amount of the variable payment depends occur). When the changes in facts and circumstances on which the variable

payment is based occur, the lessor should allocate those payments to the lease and nonlease components of the

contract. In doing so, the allocation should be on the same basis as the initial allocation of the consideration in the

contract, or the most recent modification not accounted for as a separate contract, unless the variable payment meets

the criteria in paragraph 606-10-32-40 to be allocated only to the lease component(s). After this allocation then:

Variable payment amounts allocated to the lease component(s) are recognized as income in profit or loss in

accordance with ASC 842,

Variable payment amounts allocated to nonlease component(s) are recognized in accordance with other

Topics such as ASC 606.

A lessor also allocates any capitalized costs (for example, initial direct costs or contract costs capitalized under ASC

340-40 on other assets and deferred costs) to the separate lease components or nonlease components to which those

costs relate.

ACCOUNTING FOR LEASES UNDER ASC 842 28

Example 4B - Lease of Land and Building (Continued) – Lessor Accounting

FACTS

Let’s continue with Example 4 in which Lessor and Lessee enter into a five-year lease of a single-story

commercial office building.

Lessee has exclusive use of the building (i.e., it is a single-tenant office building).

The lease requires Lessor to perform landscaping services for Lessee.

Lessee pays a fixed monthly payment of $12,000 per months in arrears which includes rent, landscaping

services, and reimbursement of Lessor’s costs.

Assume there are no lease incentives or initial direct costs.

WHAT ARE THE COMPONENTS?

SCENARIO 1: Lessor elects practical expedient not to separate for this asset class.

Lessor determines that it meets the scope conditions of the practical expedient under paragraph 842-10-

15-42A because:

•

The landscaping services would otherwise be accounted for under ASC 606.

•

The lease component would be accounted for as an operating lease. Lessor performed this

assessment qualitatively considering the terms of the contract (Additional guidance on lease

classification will be covered in the next article in this series,

Lease Classification and Key

Terms

).

•

The lease component and nonlease component have the same timing and pattern of transfer (i.e.,

overtime, time-based). Lessor determined that the pattern of transfer of the landscaping services

would be time-based and over time under ASC 606 based on the nature of the performance

obligation.

Lessor also determines that the nonlease component is not the predominant component, because Lessee

would be reasonably expected to ascribe more value to the lease component than the nonlease

component.

Lessor notes that paragraph 842-10-15-42C is not applicable because there is only one nonlease

component and it qualifies for the practical expedient not to separate.

Accordingly, the contract includes one lease component (i.e., the combined components), which Lessor

accounts for as an operating lease under ASC 842 consistent with paragraph 842-10-15-42B.

SCENARIO 2: Lessor does not elect practical expedient not to separate for this asset class.

As previously evaluated in Example 4, the contract includes two components: a single lease component

(comprising the right to use the land and building), and a nonlease component (landscaping services).

Also, Lessor determines under ASC 606 that its landscaping services represent a single performance

obligation.

WHAT IS THE CONSIDERATION IN THE CONTRACT?

There are no variable payments in the contract. Therefore, the guidance in paragraph 842-10-15-39 does

not apply.

The consideration in the contract for Lessor is $12,000 X 12 months X 5years = $720,000.

ACCOUNTING FOR LEASES UNDER ASC 842 29

WHAT ARE THE AMOUNTS ALLOCATED TO THE LEASE COMPONENT?

SCENARIO 1: Lessor elects practical expedient not to separate for this asset class.

The consideration in the contract of $720,000 is allocated entirely to the lease component.

Lessor accounts for the lease component as an operating lease in accordance with paragraph 842-10-15-

42B, and therefore recognizes $720,000 on a straight-line basis over the lease term.

SCENARIO 2: Lessor does not elect practical expedient not to separate for this asset class.

In that case, Lessor allocates the consideration in the contract to the lease and nonlease components on a

relative standalone selling price basis. Lessor determines that the standalone selling prices for the lease

component and nonlease component are $680,000 and $50,000, respectively, using the guidance in ASC

606.

Therefore, the consideration in the contract is allocated to the lease and non-lease components as

follows:

Standalone

Selling Price

Relative Standalone

Selling Price

Lease component

$680,000

$670,685 (93.15%)

Maintenance component

50,000

49,315 ( 6.85%)

$730,000

$720,000

The amount of the consideration in the contract allocated to the lease component ($670,685) is used to

account for the lease component (e.g., assess lease classification, recognize lease revenue, etc.).

The amount of consideration for the landscaping component ($49,315) is accounted for under ASC 606.

ACCOUNTING FOR LEASES UNDER ASC 842 30

Example 5B - Lease of Office Space (Continued) – Lessor Accounting, Practical Expedient Not to Separate Is

Elected

FACTS

Let’s continue Example 5 in which Lessor and Lessee enter into a five-year lease for one floor in a 30-

story office building in New York City.

The lease requires Lessor to perform common area maintenance (CAM) services.

The contract requires Lessee to pay rent of $50,000 per month in arrears and to reimburse Lessor for

Lessee’s pro-rata share of real estate taxes and insurance incurred by Lessor on the building, and CAM

charges.

The pro rata share of those reimbursements is initially estimated at $9,000 per month ($5,000 for taxes

and insurance and $4,000 for CAM). The CAM charges can be adjusted upward and downward based on

actual work performed by Lessor.

Assume there are no lease incentives or initial direct costs.

Lessor elects the practical expedient not to separate for this asset class.

WHAT ARE THE COMPONENTS?

Lessor determines that it meets the scope conditions of the practical expedient in paragraph 842-10-42A

because:

•

The CAM services would otherwise be accounted for under ASC 606.

•

The lease component would be accounted for as an operating lease. Lessor performed this

assessment qualitatively considering the terms of the contract (Additional guidance on lease

classification will be covered in the next article in this series,

Lease Classification and Key

Terms

).

•

The lease component and nonlease component have the same timing and pattern of transfer (i.e.,

over time, time-based). Lessor determined that the pattern of transfer of CAM would be time-

based and over time under ASC 606 based on the nature of the performance obligation.

Lessor also determines that the nonlease component is not the predominant component, because Lessee

would be reasonably expected to ascribe more value to the lease component than the nonlease

component.

Lessor notes that paragraph 842-10-15-42C is not applicable because there is only one nonlease

component and it qualifies for the practical expedient not to separate.

Accordingly, the contract includes one lease component (i.e., the combined components).

ACCOUNTING FOR LEASES UNDER ASC 842 31

WHAT IS THE CONSIDERATION IN THE CONTRACT?

The consideration in the contract starts with the same amount as determined by Lessee, which is $50,000

X 12 months X 5years = $3,000,000

There are variable payments in the contract. Therefore, Lessor applies the guidance in paragraph 842-10-

15-39. However, Lessor determines that the payments Lessee will make to Lessor for its prorata share of

real estate taxes and insurance are variable payments that are not based on an index or a rate, and they

relate to the lease component.

Also, although the CAM payments relate specifically to the CAM services, Lessor elected the practical

expedient and therefore those payments are considered to relate to the lease component.

Accordingly, the expected amounts for property taxes, insurance and CAM are excluded from the

consideration in the contract in accordance with paragraph 842-10-15-40.

The consideration in the contract for Lessor is $3,000,000.

WHAT ARE THE AMOUNTS ALLOCATED TO THE LEASE COMPONENT?

The lease is accounted for as an operating lease consistent with paragraph 842-10-15-42B.

The consideration in the contract of $3,000,000 is allocated entirely to the lease component and is used

to recognize lease revenue on a straight-line basis over the lease term.

Because Lessee reimburses Lessor for property taxes and insurance (as opposed to paying directly a third-

party), Lessee’s payments for its prorata share of those activities are considered lessor costs in

accordance with paragraph 842-10-15-40A and are recognized on a gross basis in profit or loss.

Since Lessor elected the practical expedient not to separate, variable payments for property taxes,

insurance and CAM are considered variable lease payments and are recognized in accordance with

paragraph 842-30-25-11(b), which is when the changes in facts and circumstances on which the variable

payments are based occur.

ACCOUNTING FOR LEASES UNDER ASC 842 32

Example 5C - Lease of Office Space (Continued) – Lessor Accounting, Practical Expedient Not to Separate Is Not

Elected

FACTS

Let’s continue Example 5 in which Lessor and Lessee enter into a five-year lease for one floor in a 30-

story office building in New York City.

The lease requires Lessor to perform common area maintenance (CAM) services.

The contract requires Lessee to pay rent of $50,000 per month in arrear and to reimburse Lessor for

Lessee’s pro-rata share of real estate taxes and insurance incurred by Lessor on the building, and CAM

charges.

The pro rata share of those reimbursements is initially estimated at $9,000 per month ($5,000 for taxes

and insurance and $4,000 for CAM). The CAM charges can be adjusted upward and downward based on

actual work performed by Lessor.

Assume there are no lease incentives or initial direct costs.

Lessor does not elect the practical expedient not to separate for this asset class.