ATTACHMENT G

26

SF-424A INSTRUCTIONS--DEVELOPING A BUDGET

ETA’s Regions 2 and 6 have developed a helpful budget tool which was emailed to all

grantees in 2008, and which is being transmitted again by email with this PY 2009

planning TEGL. Grantees are strongly encouraged to utilize this tool in developing

their budget narratives. These instructions will assist you in completing the Budget

Tool and the worksheets within. References to the 424A and the 424A Budget Tool

are made at the beginning of each section in bold italics.

A. Determining Budget Requirements

The budget is one of the most important pieces of the grant proposal. A complete and

well-developed budget eventually becomes an effective management tool; a budget that

doesn’t truly represent a project’s needs and situation will make it difficult for

managers to assess financial performance over the life of the project and may result in a

grantee experiencing cost overruns. The budget also provides ETA with information

that is useful in assessing whether the activities and services described in the Statement

of Work are consistent with the estimated costs in the budget.

B. Understanding Key Budgeting Terms and Principles

Before launching into a description of the required budget elements, it is vital to explain

some key fiscal terminology and principles that may affect the development of the grant

budget.

• Administrative Costs:

o Definition: The definition of administrative costs used for SCSEP grants is

unique to the programs funded by the U.S. Department of Labor (DOL),

Employment and Training Administration (ETA). ETA’s definition of

administrative costs is found in the Code of Federal Regulations at 20 CFR

641.853-861. ETA uses a function-based definition of administration,

which means costs associated with certain functions, such as accounting,

procurement, financial management, payroll, etc. are considered

administrative costs. Program costs are those related to the direct

provision of employment and training services to participants and

employers. An individual, such as a program director, can incur both

program and administrative costs depending on the function which is

being performed.

o Limitation: An entity that receives a SCSEP grant to carry out a project or

program may not use more than 13.5% of the total amount awarded for

the grant to pay administrative costs associated with the project or

program. In limited cases, the Grant Officer may approve a 15%

administrative cost level, but the grantee will need to request a higher

level in writing in its grant submission and provide information to

document the need for the higher cost level. See Section 502(c)(3) of the

Older Americans Act (OAA) of 2006 for guidance. Typically, only the

grantee organization incurs administrative costs. A sub-grantee under the

grant would incur administrative costs only if a sub-grant is for the sole

purpose of carrying out an administrative function. The administrative

limit applies to the total award amount and includes both direct

administrative cots and indirect administrative costs. Not all indirect

costs are administrative costs under the ETA definition. The portion of

indirect costs that are administrative, plus any direct administrative costs,

cannot exceed the 13.5% cost limitation. Note: The indirect cost line item

on the Federal Budget Information Form is different from the

administrative cost limit.

• Program Costs: Program costs are those related to the direct provision of

employment and training services to participants and employers. An individual,

such as a program director, can incur both program and administrative costs

depending on the function which is being performed. For instance, when a

program director is meeting with project partners to discuss how services will be

designed and provided to participants, the salary associated with that time is a

program cost. However, when a project director spends time developing a

budget for a contractual agreement with a project partner, the salary associated

with that time is an administrative cost because budgeting is an administrative

function.

• Direct Costs: Direct costs are those that can be specifically identified with a

particular final cost objective.

• Indirect Costs: Indirect costs are those that are incurred for common or joint

objectives that benefits more than one project. They may originate in your own

unit or in units or departments of your organization that supply goods, services,

or facilities to the earmark grant. Most often, the term “indirect costs” is used to

indicate costs that are incurred to support the overall operation of the

organization. Indirect costs may be both administrative and programmatic. The

following website provides valuable information on applying for an indirect cost

rate from the DOL, Division of Cost Determination:

http://www.dol.gov/oasam/programs/boc/costdeterminationguide/main.ht

m#toc.

• Cost Allocation Plan: This document identifies, accumulates, and distributes

allowable direct and indirect costs and identifies the allocation methods used for

distribution of these costs across projects.

27

28

C. Process for Developing a Budget

Constructing a project budget takes time and involves coordinating with project staff

and partners. When developing the project budget, it is highly recommended that

grantees review the activities and tasks listed in their statement of work. Reviewing the

statement of work will help grantees assess the following elements:

• Who will do the work on the project and how long their services will be required

based on the proposed tasks (e.g., grant staff, partner staff, contractors);

• What types of resources are needed to support each task (e.g., rent, utilities,

computers, telephone service, copiers, office supplies, etc.); and

• Whether partners are willing to donate cash, items, or services needed to

complete the project either through matching funds or through in-kind

contributions.

The Budget Narrative worksheets in the SF-424A are designed to assist grantees in

meeting the requirements for a detailed cost analysis and may be helpful to use when

developing your budget projections. It may also be useful to have staff involved in

delivering services participate in preparing the budget assumptions since they have

direct, first-hand experience with providing the service or activity. Also, grantees

should be aware that a number of factors might affect the budget projections. Some

examples of factors affecting budget estimates include:

• Staff on the project may be eligible for salary increases or raises during the life of

the project;

• The rising costs of health insurance and worker disability insurance may affect

the fringe benefit rates; and

• Transportation costs may be affected by rising gasoline prices.

Grantees should try to anticipate factors that may affect the budget when developing

their projections and be prepared to provide a narrative explanation of these factors in

the Budget section of the grant proposal. Once grantees have developed a list of needed

resources it is time to organize the listed items into the cost categories required by ETA.

D. How to Complete the Budget Section of the SCSEP Application

The Budget part of the SCSEP application consists of two sections: A – Budget

Information Form, and B – Budget Category Excel Worksheets and Budget Narrative.

Section A. Budget Information Form - Lines 1 through 5, Columns (a) through (g)

(Note: Column F is pre-set to calculate the 10 percent non-Federal amount. You may

clear the column or change the formula if you are entering more than 10 percent)

29

A budget tool has been developed which should assist grantees in submitting their SF-

424A and detailed budget narrative (see attached). The SF-424A can be found at

http://www.doleta.gov/sga/forms/form424a.pdf. The budget form has six sections.

A - Budget Summary; B - Budget Categories; C - Non-Federal Resources; D - Forecasted

Cash Needs; E - Budget Estimates of Federal Funds Needed for Balance of the Project;

and F - Other Budget Information. Sections A and B of the SF 424A are populated

automatically as the budget category Excel worksheets, addressed below, are

completed. The following information should be entered on the first row of section A:

column (a) – SCSEP; column (b) – 17.235. Information in columns (e) and (g) will be

input automatically after the “Amount Awarded” field in the top left corner of

“Personnel” worksheet is filled in. Please note that ETA does not require sections E and

D be completed.

Grantees anticipated expenses are listed in the object class categories in Section B -

Budget Categories. It should be noted that for purposes of this budget, costs associated

with participant wages and fringe benefits should be categorized the following ways:

When a participant has a community service employment assignment at the

grantee’s facilities and is considered an employee of the grantee, then participant

wage costs should be listed in “Personnel” and fringe benefits in “Fringe

Benefits”.

When a participant has a community service employment assignment at a host

agency or sub-recipient’s facilities, but is considered an employee of the grantee,

then participant wages costs should be listed in “Personnel” and fringe benefits

in “Fringe Benefits”.

When a participant has a community service employment assignment at a host

agency or sub-recipient’s facilities, and is considered an employee of the host

agency or sub-recipient, then participant wage and fringe benefit costs should be

listed under “Contractual”.

• Personnel: This refers to wages/salaries paid to employees of the grantee

organization who are directly involved in grant implementation. This line item

does not include personnel hired by the sub-grantee; those costs are included in

the “Contractual” line item.

• Fringe Benefits: The cost of benefits paid to the personnel on the grant,

including the cost of employer’s share of FICA, health insurance, workers’

compensation, vacation and supplies. Shipping and delivery are a normal part of

the cost of supplies and should be included in the budgeted amount.

• Contractual: The cost of any contract or sub-grant agreement. Contractual costs

could include sub- and sick leave, holidays, or unemployment insurance. The

budget worksheet for this category should contain descriptive information about

30

what specific fringe benefits are being charged to the grant, including the fringe

benefit percentage.

• Travel: Refers to travel costs of personnel that are reasonable and necessary to

effectively manage and carry out grant activities, provide oversight or measure

program effectiveness. Air travel, when necessary, should be obtained at the

lowest possible customary standard (coach or equivalent fare). Travel costs may

be charged on an actual basis or on a per-diem or mileage basis in lieu of actual

costs. This line item does not include travel expenses of the sub-grantee; those

costs are included in the “Contractual” line item.

• Equipment: Refers to non-expendable personal property that has a useful life of

more than 1 year and a per-unit cost of $5,000 or more. The only type of

equipment that may be acquired with Federal funds is equipment necessary for

the operation of the grant. In the instance of a purchase, the cost of the

equipment is to be prorated over the projected life of the equipment to determine

the cost to the grant. Use of grant funds to purchase equipment with a unit cost

of $5,000 or more requires special review and approval from the Grant Officer

prior to purchase. Shipping, delivery, and installation if necessary are a normal

part of the cost of equipment and should be included in the budgeted amount.

• Supplies: All consumable materials costing less than $5,000 per unit; other

goods such as copy paper, pens and pencils, computers; any materials needed to

conduct training, agreements for evaluating the grant, providing training, etc.

The total costs of all sub-grant contracts are reflected in this line item.

• Other: Direct costs that do not fit any of the aforementioned categories, such as

rent for buildings used to conduct grant activities, utilities and/or leased

equipment, child care, transportation expenses, tuition for training, etc. are

reflected in the “Other” line item.

• Total Direct Cost: This is the total of lines 1 through 7. The SF-424A will

automatically sum up the direct costs after the worksheets for each category are

completed.

• Indirect Cost: If the grantee has an approved indirect cost rate and wishes to

apply it to this grant, then a copy of the indirect cost agreement, signed by the

issuing Federal agency must be included as an attachment to the grant proposal.

• TOTALS: This category is populated automatically and represents the total

amount of lines 6(i) and 6(j), equaling to the total amount of funds authorized for

the project.

Section B. Budget Category Excel Worksheets and Budget Narrative - This section is

directly linked to the colorful, labeled tab in the worksheets. When you complete the

spreadsheet behind each tab, the total will appear in the appropriate line or column in

this section.

31

Budget Category Excel Worksheets: The SF 424A Section B requires grantees to

classify expenses in the following object class categories: Personnel, Fringe Benefits,

Travel, Equipment, Supplies, Contractual, Construction (not used for SCSEP grants),

Other, and Indirect Costs. The attached suggested budget tool contains an individual

worksheet for each of these object class categories. Complete the Budget Category

Worksheets for each object class category. Each worksheet identifies in detail the costs

attributable to each object class category in Section B, lines 6(a) – 6(j) of the SF 424A. The

worksheet cells contain instructions and drop down menus to aid in their completion.

Data from the completed budget worksheets will automatically populate Sections A

and B the SF-424A. Grantees should distinguish those costs associated with Federal

funding and those costs associated with non-Federal funding (perhaps bolding Federal

costs)

Budget Narrative: At the bottom of each worksheet is a text block to enter a budget

narrative. The budget narrative explains or justifies the amounts entered for each

Object Class Category on SF-424A and the supporting worksheets. A brief explanation

should be provided which explains how the costs associated with each object class

category relate to the implementation of the statement of work and the achievement of

grant goals. Grantees should try to anticipate factors that may affect the budget when

developing their projections and provide a narrative explanation of these factors. In

this section, grantees also include a narrative explanation describing the percent of the

award amount that will be spent on administrative costs, including a description of

administrative services being charged to the grant. The narrative ties the grant budget

to the proposal's Statement of Work

The following section provides directions for completing the budget category

worksheets as well as examples of completed worksheets and budget narrative

statements.

Personnel Worksheet

This is the first worksheet in the SF-424A MS Excel workbook. Grantees should start by

typing in the Name of Grantee Organization, Amount Awarded, and Funding Period

(From-To). The funding period of performance cannot begin prior to February 17, 2009

(for Recovery Act) or July

1, 2009 (for program year funds). The worksheet will not

calculate the values if this initial information is not provided. Here and on the other

worksheets data can be entered in the cells colored in light green.

The following information to support the staffing plan for the project should be

provided in the Personnel table:

• Position: Enter the title for each staff position. These titles should match the

information provided in the technical proposal. If the grantee has more than one

32

employee in the same position, at the same salary level and employed for the

same period of time, each employee should be entered on a separate line.

• % of Time: List the percent of time each staff person will devote to the project.

For example, if a staff person were full-time but only spending 75% of their time

on the project, he or she would be .75 FTE (full-time equivalent).

• Monthly Salary/Wage: Enter the average monthly salary, not the average full-

time salary. Since pay periods vary from organization to organization, the

average would be the annual total salary divided by 12 months. If an employee

is expected to receive a salary increase during the grant period, figure the

average monthly salary for the entire year based on the sum of the two salary

figures for the number of months the employee will receive each salary.

• # of Months: Enter the projected number of months the position will be filled

during the grant period.

• Cost: The total cost equals (% of Time) x (Monthly Salary/Wage) x (# of

Months).

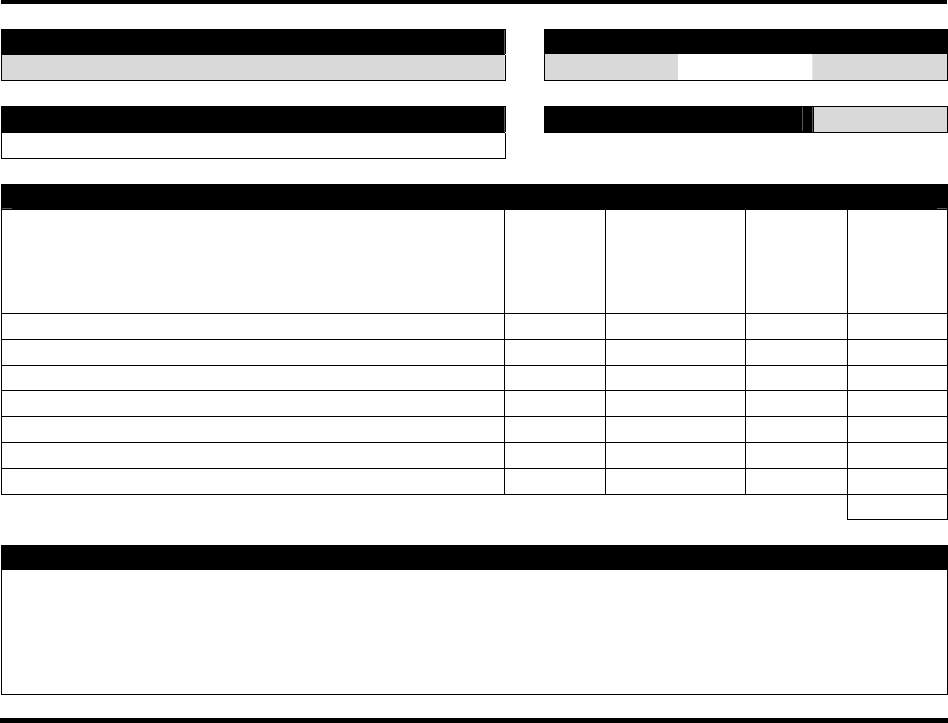

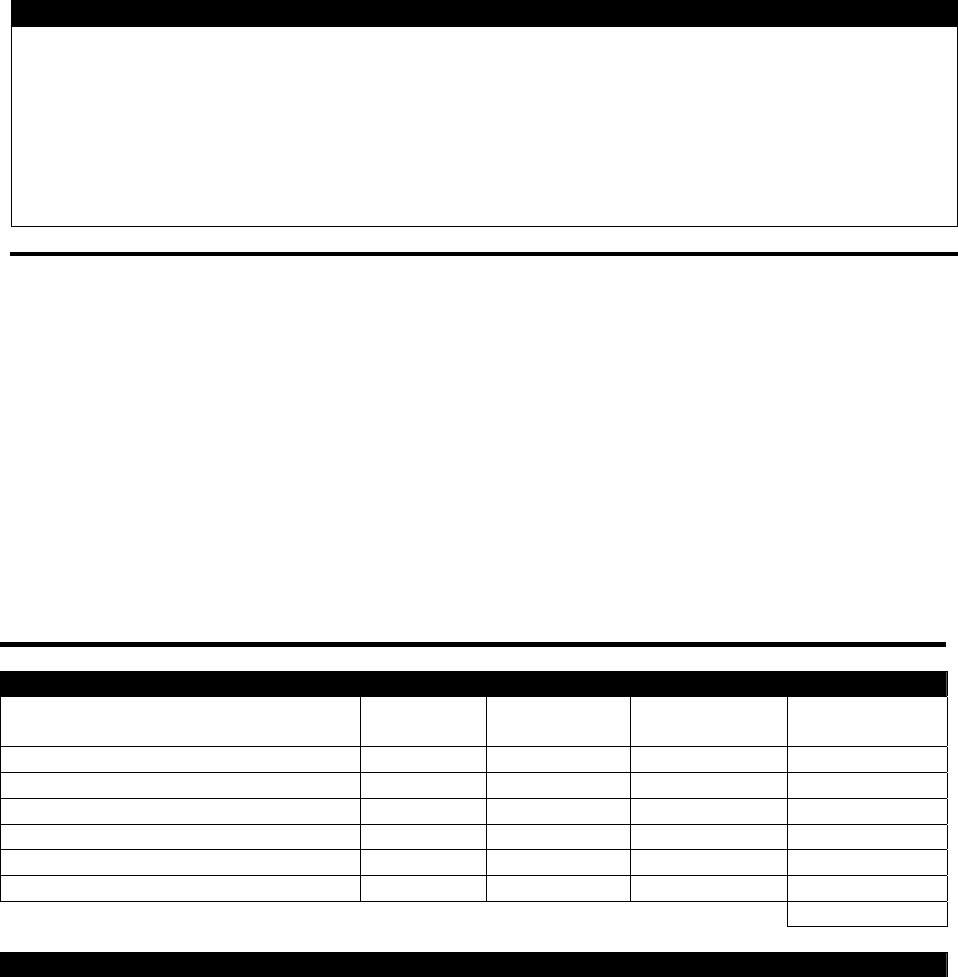

Name of Grantee Organization Funding Period

The Best Workforce Development Program, Inc.

07/01/08 to 06/30/09

Amount Awarded # of Months

12

$ 500,000

Object Class Category (a.): PERSONNEL

A B C D E

Position

% of

Time

Monthly

Salary/Wage

# of

Months

Cost

1. Executive Director 20.00% $ 3,600 12.00 $8,640

2. Project Director 100.00% 2,200 12.00 $26,400

3. Administrative Assistant 50.00% 1,200 12.00 $7,200

4. Job Developer 100.00% 2,000 12.00 $24,000

5. Case Worker 100.00% 1,600 10.00 $16,000

6. Case Worker 100.00% 800 10.00 $8,000

7. Outreach Specialist/Recruiter 40.00% 1,400 12.00 $6,720

TOTAL PERSONNEL $96,960

Budget Narrative: PERSONNEL

The total amount for Staff Salaries is projected to be $96,960. The Project anticipates the need for seven

staff persons, four of whom – Project Director, Job Developer and two Case Workers, will work full-time

on the project. The Administrative Assistant will dedicate 50% of his/her time to the project and the

Outreach Specialist/Recruiter will spend 40% of his/her time. Executive Director of the project will

spend 20% of his/her time on the project activities.

33

Fringe Benefits Worksheet

In this worksheet grantees should provide a detailed listing of the benefits provided to

employees as well as the fringe benefit percentage.

• Position/s: Using the drop down menu, select the position title. The drop down

menu will reflect the positions listed in the Personnel worksheet.

• Benefit/s: Using the drop down menu, select the type of benefits that will be

provided. If multiple benefits are included in the base amount, list each of them

in a separate row.

• Rate: Enter the fringe benefit rate used to calculate benefits for each source. If the

list of fringe benefits is itemized, list the source for each item.

• Base Amount: Enter the Gross Salary used against the rate for the salary/s you

are calculating.

• Cost: The total cost is (Rate) x (Base Amount)

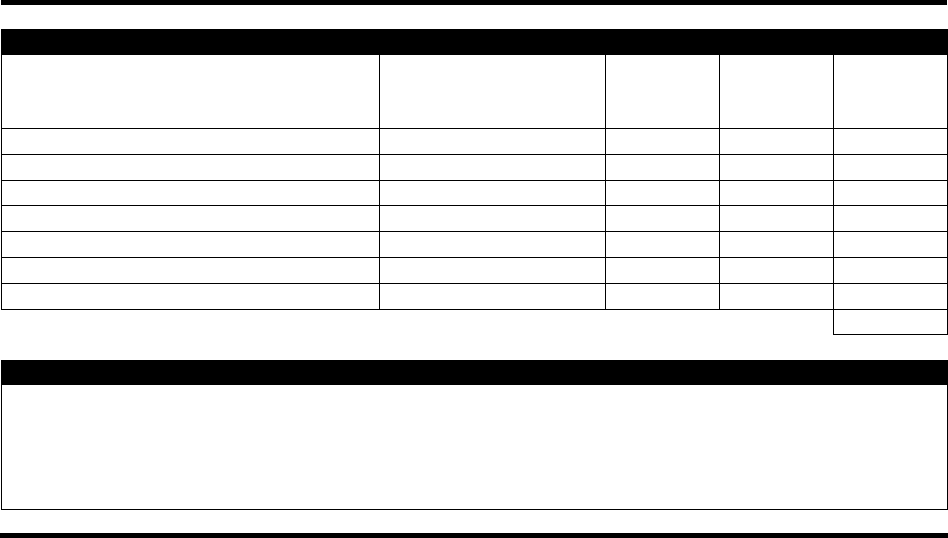

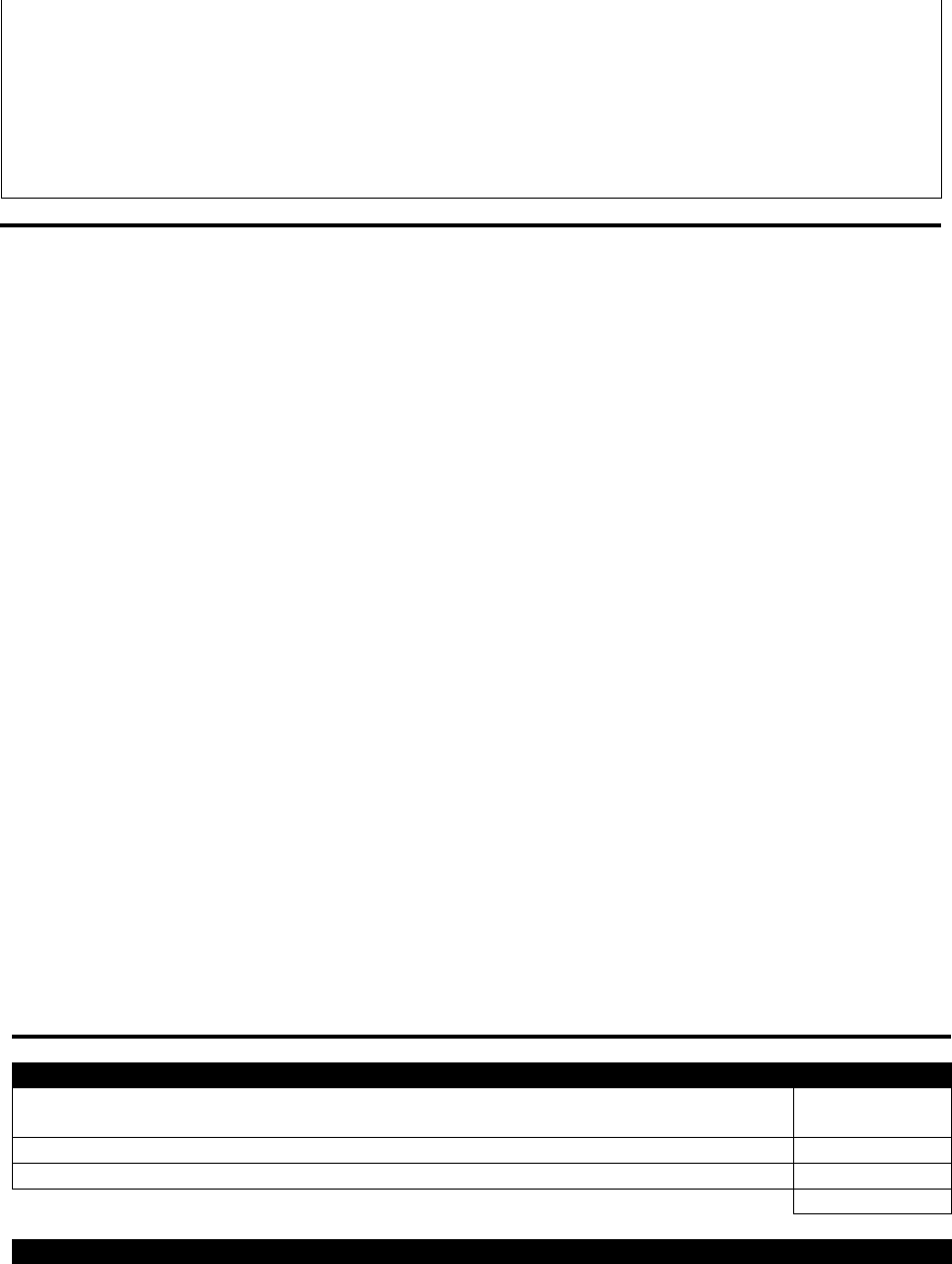

Object Class Category (b.): FRINGE BENEFITS

A B C D E

Position/s Benefit/s Rate

Base

Amount

Cost

1. Executive Director Disability (Long-Term)

1.20% $ 8,640 $ 104

2. Project Director Full Package 34.00% 26,400 8,976

3. Administrative Assistant Full Package 34.00% 7,200 2,448

4. Job Developer Full Package 34.00% 24,000 8,160

5. Case Worker Full Package 34.00% 16,000 5,440

6. Case Worker Full Package 34.00% 8,000 2,720

7. Outreach Specialist/Recruiter Full Package 34.00% 6,720 2,285

TOTAL FRINGE BENEFITS $ 30,133

Budget Narrative: FRINGE BENEFITS

The fringe benefit rate for 6 employees of this project is 34% of staff salaries or $30,133 and accounts for

the full package of benefits that consists of (a) medical, dental and vision coverage; (b) short- and long-

term disability insurance; (c) holiday and sick leave pay; (d) life insurance; and (e) FICA and

Unemployment Insurance. Fringe benefit rate for the Executive Director position is 1.20% and includes

the Long-Term Disability Insurance only.

Travel Worksheet

Travel includes mileage, plane fare, meals and incidentals, lodging, and any other cost

associated with travel for the grant including parking and taxi or shuttle service to and

from the site. Travel costs may be charged on an actual basis or on a per-diem or

mileage basis in lieu of actual costs.

34

Grantees should provide a narrative describing the purpose of the travel and the

assumptions used to generate the travel amounts. Each type of travel cost (e.g. mileage,

per diem, etc.) should be entered on separate lines.

• Item: Enter a brief description of the travel item to be charged to the grant.

Remember, travel for contracted employees is entered under “Contractual”

category.

• # of Staff: Enter the number of staff who will charge this type of travel.

• # of Units: Enter the number of units estimated to be charged to the grant per

traveler (staff) for the year.

• Unit Type: From the drop-down menu, choose the unit type to be used for the

calculation.

• Cost per Unit: Enter the cost of the travel item per traveler. If calculating based

on mileage, enter the cost per mile.

• Cost: The total cost is (# of Staff) x (# of Units) x (Cost per Unit)

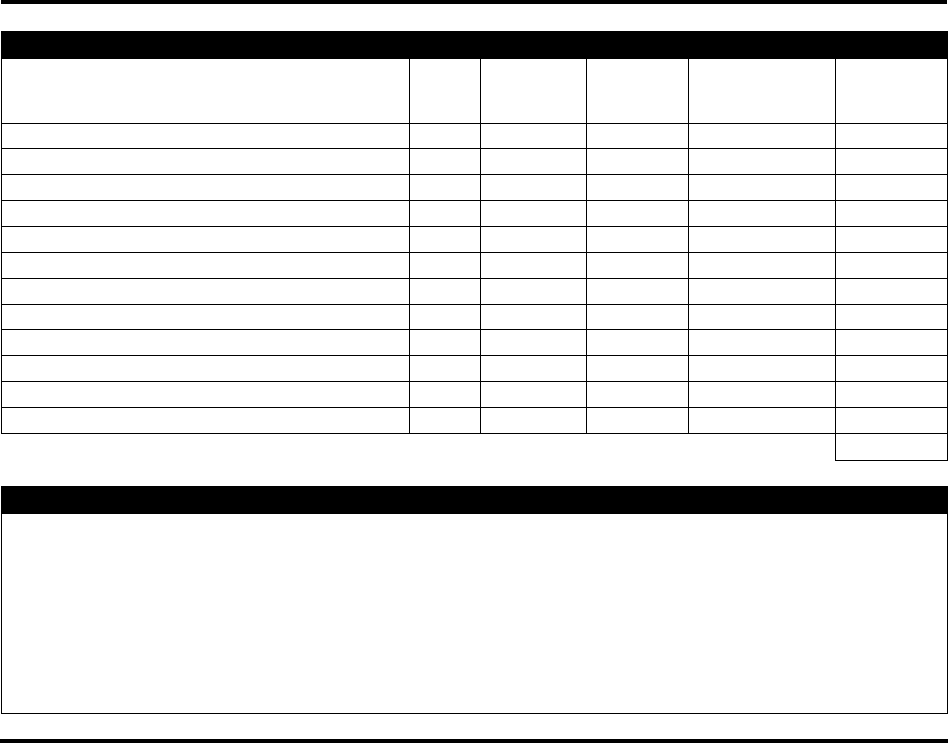

Object Class Category (c.): TRAVEL

A B C D E F

Item

# of

Staff

# of

Units

Unit

Type

Cost per Unit Cost

1. Mileage - Project Director 1 8,000

Miles $ 0.42 $ 3,360

2. Mileage - Job Developer 1 12,000

Miles 0.42 5,040

3. Mileage - Case Manager (Full-Time) 2 10,000

Miles 0.42 8,400

4. Mileage - Outreach Specialist 1 5,000

Miles 0.42 2,100

5. Per Diem - Project Director 1 40

Day/s 35.00 1,400

6. Per Diem - Job Developer 1 40

Day/s 35.00 1,400

7. Per Diem - Case Manager (Full-Time) 2 40

Day/s 35.00 2,800

8. Per Diem - Outreach Specialist 1 20

Day/s 35.00 700

9. Lodging for Training/Conferences 4 3

Day/s 100.00 1,200

10. Per Diem for Training/Conferences 4 4

Day/s 35.00 560

11. Plane Tickets for Conferences 4 1

Trip/s 350.00 1,400

12. Miscellaneous Travel 5 10

Month/s

50.00 2,500

TOTAL TRAVEL

$ 30,860

Budget Narrative: TRAVEL

Mileage costs for the Project Director, Job Developer, two Case Managers, and Outreach Specialist, are

to conduct recruitment and provide outreach throughout the District. Mileage is calculated at 42 cents

per mile with an estimated total mileage of 45,000 miles over two years. Per Diem rates for the staff is

calculated at $35 per day based on the organizational travel policies; the staff will travel to local

community colleges, community-based organizations, and high schools to present the program to other

populations. Lodging, per diem, and transportation ticket costs for Training/Conferences is reserved

for the DOL Earmark training session. Miscellaneous Travel funds are for transit transportation costs for

staff’s local travel. Total cost of travel is $30,860.

35

Equipment Worksheet

Equipment is defined at both 29 CFR 97.3 and 95.2 as tangible, non-expendable personal

property having a useful life of more than one year and an acquisition cost which

equals or exceeds the lesser of (a) the capitalization level established by the organization

for the financial statement purposes, or (b) $5,000 per unit cost. If the cost of equipment

was not charged directly to the grant or sub-grant at the time of acquisition, then the

equipment does not fall under the property management requirements of Section 95.34.

Items that cost less than $5,000 per unit should be entered under the Supplies

worksheet, unless the item is part of a larger system. For example, if the item is part of

the organization’s Information Technology (IT) system it would be considered

equipment regardless of the unit cost of the item (see the example below). Shipping,

delivery, and installation (when necessary) are a normal part of the cost of equipment

and should be included in the budgeted amount.

Grantees wishing to obtain approval for the purchase of equipment at the time of

proposal submission should state their intentions in the Budget Narrative section of the

worksheet and provide the following information: an explanation of how this

equipment will be used to further the grant’s objectives, a justification for the need for

the equipment, the basis for valuation of the equipment, and a description of the

equipment to be purchased. If the equipment is approved, the grant officer will so state

in the letter transmitting the grant award to the grantee. Otherwise, the grantee must

make a subsequent request in writing to the Grant Officer at a later date for approval to

purchase equipment.

For audit purposes, grantees should maintain equipment records that include the

following data on equipment: description; identification number; funding source; title

holder; acquisition date; percentage of Federal participation in the cost; location,

condition and last inventory date; acquisition cost; and ultimate disposition date,

including date of disposal and sale price or current fair market value, including method

used to determine the value. This information is not required in developing the Grant

Proposal, but should be readily available for monitoring purposes by Federal staff

and/or auditors.

Object Class Category (d.): EQUIPMENT

A B C D

Item # of Items Cost per Item Cost

1. Die Cutting Machine 1 5,500 $ 5,500

2. LAN Equipment 1 6,500 6,500

3. LAN Monitoring & Administration Software 1 1,000 1,000

TOTAL EQUIPMENT

$ 13,000

36

Budget Narrative: Equipment

Die cutting machine will be used by the program participants to provide the hands-on experience on

die-cutting and embellishing. The project will be purchasing one machine at $5,500. This is an average

price for the industrial die cutting machines available on the market today. The project will also will also

purchase LAN switches and routers, as well as LAN cables so that staff on the project can connect their

computers to the company network. The total price of LAN Equipment to be purchased is $6,500. LAN

monitoring and administration software will be used to maintain the security of the company network.

The software will be purchased at $1,000. Prices for LAN equipment and software are estimated based

on the average prices of LAN equipment and software on the market.

Supplies Worksheet

Supplies refers to all consumable materials, items costing less than $5,000 per unit, and

other goods such as copy paper, pens and pencils, materials needed to conduct training,

computers, printers, etc. Supply purchases are charged to the grant at their actual

prices after deducting all cash discounts, trade discounts, rebates, or allowances.

Shipping and delivery are a normal part of the cost of supplies.

Supplies should be lumped under larger categorical headings and detailed information

on computations justifying the respective amounts should be provided. The basis for

all estimates should be indicated in the chart or as a separate narrative.

Object Class Category (e.): SUPPLIES

A B C D E

Item # of Units Unit Type Cost per Unit Cost

Office Supplies 13 Month/s $ 100 $ 1,300

Books for Die Cutting Class 100 Item/s 40 4,000

Protective Eye Wear 100 Item/s 12 1,200

Computer and Printer 4 Item/s 1,000 4,000

Miscellaneous 1 Item/s 175 175

Postage 12 Month/s 100 1,200

TOTAL SUPPLIES $ 11,875

Budget Narrative: SUPPLIES

37

Contractual Worksheet

The cost of any contract or sub-grant agreement between the grantee and another

organization (i.e., vendor) should be included on the worksheet. Contractual costs

could include sub-agreements for evaluating the grant, providing training, maintenance

contracts, other service contracts, etc. The budget description should provide the name

of the vendor if known, an explanation of the services to be provided under the contract

or sub-agreement and the contracted amount. In most instances, the name of the

vendor will not be known since the grantee will not enter into a procurement action

until after the grant is awarded.

The term “procurement” is used to identify the process of acquiring goods and services

from sources outside of the grantee organization. Federal regulations require that all

procurements provide for full and open competition to the maximum whenever

practicable and possible. Non-competitive procurements can only be used in very

limited circumstances and should be viewed as a “last resort.”

In some limited instances, a partner may be identified in the grant application prior to

the grant award. To qualify as a partner, the partner organization needs to have been

part of the proposal development, has to have brought some resources into the

program, and needs to be an integral part of the project’s scope of work. The

involvement of the partner organization in these activities needs to be adequately

documented in the procurement record. The procurement record for a partner, as well

as service provider procured after grant award, must provide the procurement history,

the basis for the contractor selection, and if applicable, justification for lack of

competition, as well as the basis for the award cost or price.

Object Class Category (f.): CONTRACTUAL

A B

Brief Description Cost

Contract for Die Cutting Training ABC, Corp. $ 100,000

Contract for mentors 30,000

TOTAL CONTRACTUAL $ 130,000

Budget Narrative: CONTRACTUAL

Office supplies ($1,300) include file folders, paper, pens, and other basic supplies. The budgeted

amounts listed on the SF-424A worksheets are based on an assessment of per unit costs for similar

projects from last program year (January 1, 2007 to January 1, 2008). Three computers and one printer

($4,000) will be installed in the classroom and are not a part of the organization’s IT system. Books for

Die Cutting Class are required for the training sessions. One book per participant will be purchased for

the project. Protective eye wear is required for each participant. Based on past similar training

programs, we anticipate $175 in additional training related miscellaneous supply costs will be incurred.

Postage costs will be incurred for mailing of the outreach and recruitment materials.

38

The ABC Corporation will develop a customized training curriculum for high-technology

manufacturing using instrumentation available at the organization. This is in addition to the die cutting

machine being purchased with grant funds. ABC is the only entity in the grantee area which has this

highly sophisticated equipment available, is a partner in the proposal development, is providing use of

the equipment and training facility at no cost to the grant, and is integral to the overall goal of the grant.

The total contract amount for ABC Corporation is $100,000. We will also hold a free and open

competition to procure an entity to provide mentoring services to our at-risk participants. Based on past

experience, we are budgeting $30,000 for this contract.

Other Costs Worksheet

Enter items that do not fit under any of the other cost categories, such as rent, utilities,

equipment that is rented and/or leased supportive services (e.g., child care,

transportation subsidies, etc.), and training/tuition costs. Note: Equipment cannot be

leased if the cost of leasing or renting the equipment exceeds the cost of purchasing the

equipment over the life of the grant. Copies of lease or rental agreements should be

kept on file and available for review by Federal staff and/or auditors. A description of

the activity or product should be provided as well as the unit cost for the service.

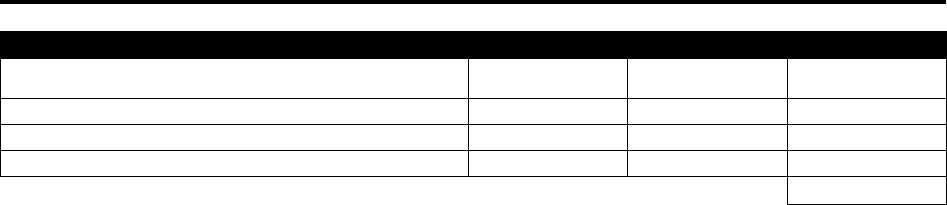

Object Class Category (h.): OTHER COSTS

(Including Training Expenses)

A B C D E

Item # of Units Unit Type Cost per Unit Cost

Die Tool Class Tuition 100 Item/s $ 1,500 $ 150,000

Rent of Classroom for Work Safety Course 45 Day/s 100 4,500

Work Safety Course for 50 attendees 2 Item/s 500 1,000

TOTAL FRINGE BENEFITS $ 155,500

Budget Narrative: Other Costs

These costs include Die Tool class tuition ($1,500) for each participant, rent of Classroom for the Work

Safety Course for approximately 50 attendees that fail the safety test.

Indirect Costs Worksheet

Indirect costs are costs that are incurred for common or joint objectives that benefits

more than one project. They may originate in your own unit or in units or departments

of your organization that supply goods, services, or facilities to the SCSEP grant. Most

often, the term “indirect costs” is used to indicate costs that are incurred to support the

overall operation of the organization. Indirect costs may be both administrative and

programmatic.

If the grantee operates with a single funding source then an indirect cost rate is not

needed. However, if the grantee has multiple funding sources - especially Federal

39

funding sources – that support the operations and activities of the organization, then an

indirect cost rate is needed.

An indirect costs rate is necessary for the equitable distribution of cost to all benefiting

activities. It provides for the systematic allocation of indirect cost to cost objectives in

reasonable proportion with the benefits received. These costs are not readily assignable

to specific awards and activities because a direct relationship to cost objectives (e.g.,

grants, contracts, fundraising, services to members, etc.) cannot be shown or would be

somewhat arbitrary in nature.

If the grantee has an approved indirect cost rate, a copy of the indirect cost agreement,

signed by the issuing Federal agency must be included as an attachment to the grant

proposal. For organizations with no prior approved indirect cost rate, and the grantee is

intending to budget for and charge indirect costs to the grant, then an indirect cost rate

proposal must be developed and submitted to the DOL, Office of Cost Determination

(OCD) no later than 3 months after the effective date of the DOL agreement.

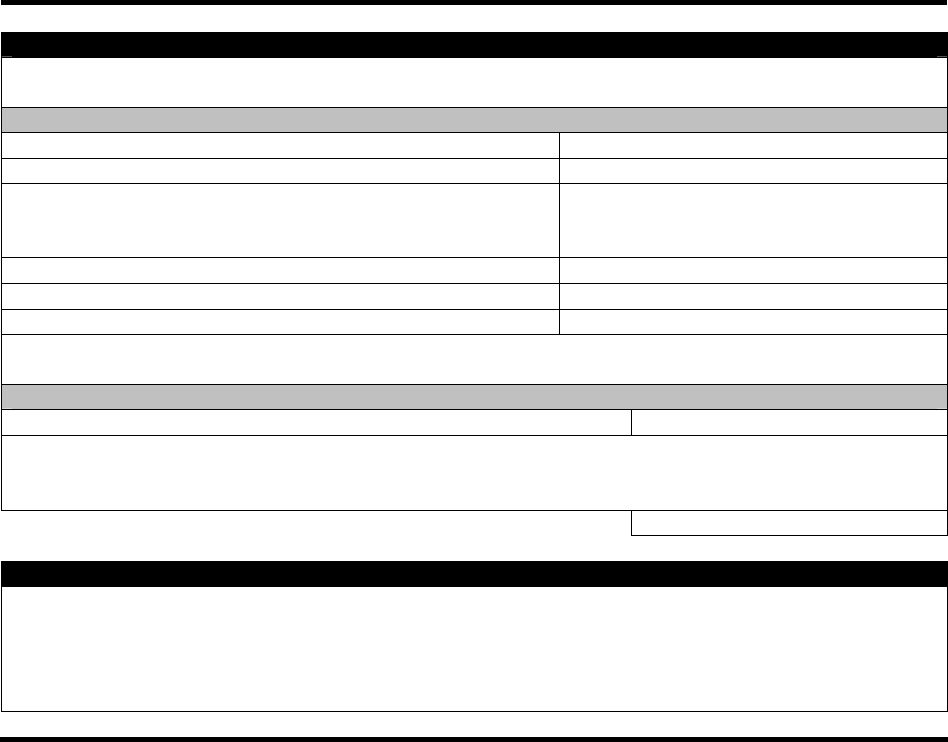

Object Class Category (i.): INDIRECT CHARGES

OPTION A

For grantees that have an approved Indirect Cost Rate Agreement

Federal agency that issued the agreement HHS

What is the approved rate (%)? 15%

What is the base against which rate is applied?

(Note: enter description as specified in the agreement)

Total direct costs excluding equipment

expenditures and that portion of each sub

award in excess of $25,000

What is the base amount ($)? $ 452,457

Enter the rate (%) that will be used for this grant 9.00%

Enter the amount ($) that will be used for this grant $ 40,721

OPTION B

For grantees that DO NOT have an approved Indirect Cost Rate Agreement

Enter fixed amount ($) that will be used

(Note: This will be only temporary until your Indirect Cost Rate Application is submitted and

approved)

TOTAL INDIRECT CHARGES 40,721

Budget Narrative: Indirect Charges

We have a currently approved indirect cost rate agreement from HHS for 15% covering the period

January 1, 2007 to December 31, 2009. The indirect cost base is total direct costs excluding equipment

expenditures and that portion of each sub award in excess of $25,000. We are only charging a 9% IDCR

to the grant in order to stay within the 10% administrative cost limitation. We will charge the balance of

the indirect costs to a non-Federal source.

Administrative Costs Worksheet

40

The administrative cost worksheet only contains a text block to enter the budget

narrative. In this section, grantees should describe the percentage and total amount of

the estimated headquarters and local administrative costs that will be charged to grant.

Budget Narrative: Administrative Costs

Administrative costs charged to this project will include salaries and fringe benefits of the Executive

Director ($8,744), the Administrative Assistant ($9,648), a portion of the postage and office supplies

($650) and a portion of the cost of the LAN equipment ($3,500), totaling $22,542 and constituting 4.5% of

the total grant award amount of $500,000.