Revision 11/30/2023

Budget Preparation Guidelines

Office of Financial Resources (OFR)

This document provides guidance for preparing a budget request and examples to help with the process. CDC applicants and

recipients must follow this guidance, which will facilitate prompt CDC review and approval of the request.

Applicants/recipients must prepare and submit a budget narrative for the following types of applications and requests

1

for

funding:

• New awards,

• Competing and non-competing continuations,

• Supplements,

• Budget revisions, and

• Carryover requests.

General Principles

• When developing the budget request, applications must be consistent with the purpose, outcomes, and program

strategy outlined in the project narrative.

• Applicants/recipients must follow federal cost principles by showing costs are allowable, allocable, reasonable, and

necessary.

2

The Office of Grants Services (OGS) Grants Management Specialist (GMS) will conduct a cost analysis to

ensure the costs meet these standards.

• Applicants/recipients must round all amounts requested to the nearest dollar and not report cents.

• Funded recipients are not allowed to use CDC grant funds to support federal income tax and other income tax costs

for employee staff, consultants, and staff paid through contracts.

3

• If there is a matching fund requirement (including in-kind contributions)

4

follow the instructions provided in the

Notice of Funding Opportunity (NOFO) and Terms and Conditions of the Notice of Award (NoA).

Cost Categories for the Budget Request

Applicants/recipients must include budget narratives addressing specific cost categories in their budget requests. There are

two types of costs, direct and indirect costs.

• Direct costs are costs that can be identified specifically for activities with a particular award, such as personnel,

fringe benefits, consultant costs, equipment, supplies, travel, other, and contractual costs.

1

U.S. Department of Health and Human Services (HHS), Grants Policy Statement, Preparing an Applicant I-17; The Application Budget I-22, Prior-

Approval Requirements II-48, January 2007 available at: http://www.hhs.gov/sites/default/files/grants/grants/policies-regulations/hhsgps107.pdf

2

Uniform Administrative Requirements, Cost Principles, and Audit Requirement for HHS Awards (45 Code of Federal Regulations (CFR)

Part 75), available at: https://www.ecfr.gov/current/title-45/subtitle-A/subchapter-A/part-75#sp45.1.75.e

3

Per 45 CFR 75.470(b), income taxes are disallowed because they are considered a personal cost which an employee is expected to handle on

his/her own. CDC considers any type of income tax a personal expense.

4

Refer to 45 CFR § 75.306 Cost sharing or matching for more information.

2

• Indirect costs (also known as “facilities and administrative costs”) are costs incurred for common or joint objectives

that cannot be identified specifically with a particular project, program, or organizational activity. Facilities

operation and maintenance costs, depreciation, and administrative expenses are examples of costs that usually are

treated as indirect costs.

Each of the cost categories for direct and indirect costs is described below. Where beneficial, examples are provided.

Personnel

For each requested position, provide the following information: 1) name of staff member occupying the position, if available;

2) annual salary

5

; 3) percentage of time budgeted for this program; 4) total months of salary budgeted; and 5) total salary

requested. Also, provide a justification, basis for the annual salary, and describe the scope of responsibility for each position

and how it relates to the accomplishment of the program objectives.

• In-kind efforts: Include staff providing in-kind services to an award under Personnel costs. Staff must not exceed

100% effort.

• For vacant positions

: The total months and amount requested should reflect any anticipated delayed start due to the

vacancy.

Fringe Benefits

Fringe benefits are usually applicable to direct salaries and wages. Provide information on the rate of fringe benefits used and

the basis for the calculation. If a fringe benefit rate is not used, itemize how the fringe benefit amount is computed.

5

Per CDC General Terms and Conditions: Cap on Salaries (Division H, Title II, General Provisions, Sec. 202): None of the funds appropriated in this

title shall be used to pay the salary of an individual, through a grant or other extramural mechanism, at a rate in excess of Executive Level II.

Note: The salary rate limitation does not restrict the salary that an organization may pay an individual working under an HHS contract or order; it

merely limits the portion of that salary that may be paid with federal funds.

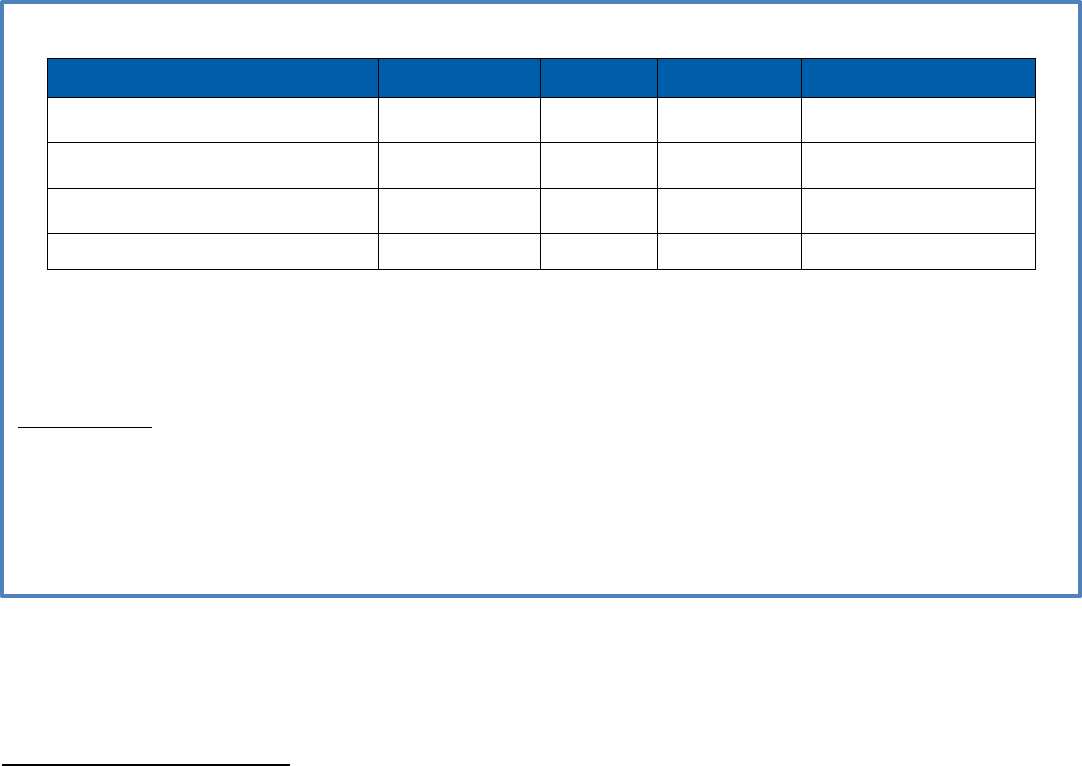

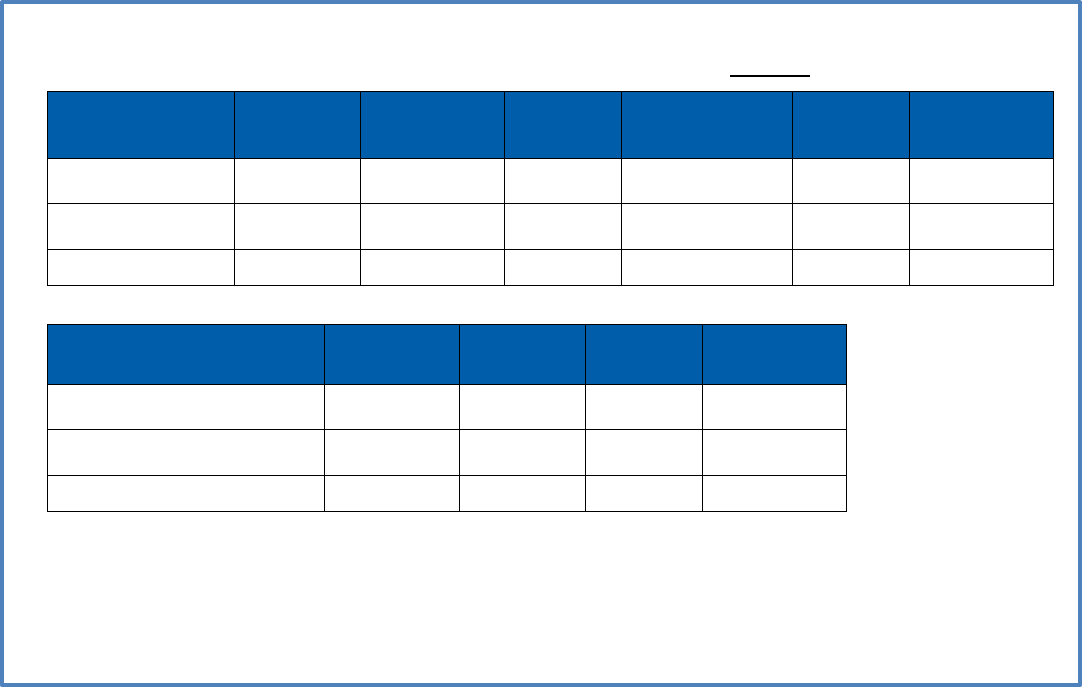

Sample Budget

Position Title and Name Annual Salary Time

Total Months Amount Requested

Project Coordinator Susan Taylor $45,000 100% 12 months $45,000

Finance Administrator John Johnson $28,500 50% 12 months $14,250

Outreach Supervisor (Vacant*) $27,000 100% 12 months $27,000

Total Personnel $86,250

Sample Justification

Write a justification for each position. The format may vary, but the description of responsibilities should be related to

specific program objectives. See example below.

Job Description: Project Coordinator – (Susan Taylor)

This position directs the overall operation of the project including but not limited to overseeing the implementation of

project activities; coordinating with other agencies; providing program and staff performance evaluation; collecting,

tabulating, and interpreting required data; and developing materials, provisions of service, and training. This individual is

the responsible authority for ensuring reports and documentation are sent to CDC. Salaries are consistent with the current

organization compensation policy.

3

Consultant Costs

This category should be used when hiring an individual to give professional advice or services (e.g., training, evaluation,

communication) for a fee, but not as an employee of the recipient organization. Recipients must receive the NOA reflecting

CDC approval of this cost prior to establishing a written agreement for consultant services. Approval must be obtained for

each budget period to reestablish the written agreement. The budget request should include a summary of the proposed

consultants and costs for each consultancy proposed detailing the seven elements below. :

1. Nature of Services to Be Rendered: Describe the consultation that will be provided, including the specific tasks to

be completed and specific deliverables. A copy of the actual consultant agreement should not be sent to CDC.

2. Relevance of Service to the Project: Describe how the consultant services relate to the accomplishment of specific

program objectives.

3. Expected Rate of Compensation: Specify the rate of compensation for the consultant (e.g., rate per hour, rate per

day). Include a budget showing other costs (e.g., travel, per diem, supplies, and other related expenses) and list a

subtotal.

4. Number of Days of Consultation (basis for fee): Specify the total number of days, estimated duration of consultation.

5. Name of Consultant: Identify the name of the consultant and describe his or her qualifications.

6. Organizational Affiliation (if applicable): Identify the organization affiliation of the consultant.

7. Method of Accountability: Describe how the progress and performance of the consultant will be monitored. Identify

who is responsible for supervising the consultant agreement.

Elements 1-4 are required for approval of consultant cost requests. If these elements are not known at the time the

application is submitted, the cost will not be approved and the recipient may submit these details as a prior approval

request.

6

If elements 5-7 are not available at time of application, recipients may submit the remaining details as they

become available via GrantSolutions Grants Management Services (GSGMS) Grant Notes for non-research and via email

to the assigned Grants Management Specialist (GMS) and Scientific Project Officer/Project Officer (SPO/PO) for research.

6

For more information about prior approval requests, please review the prior approval guidance on the CDC website.

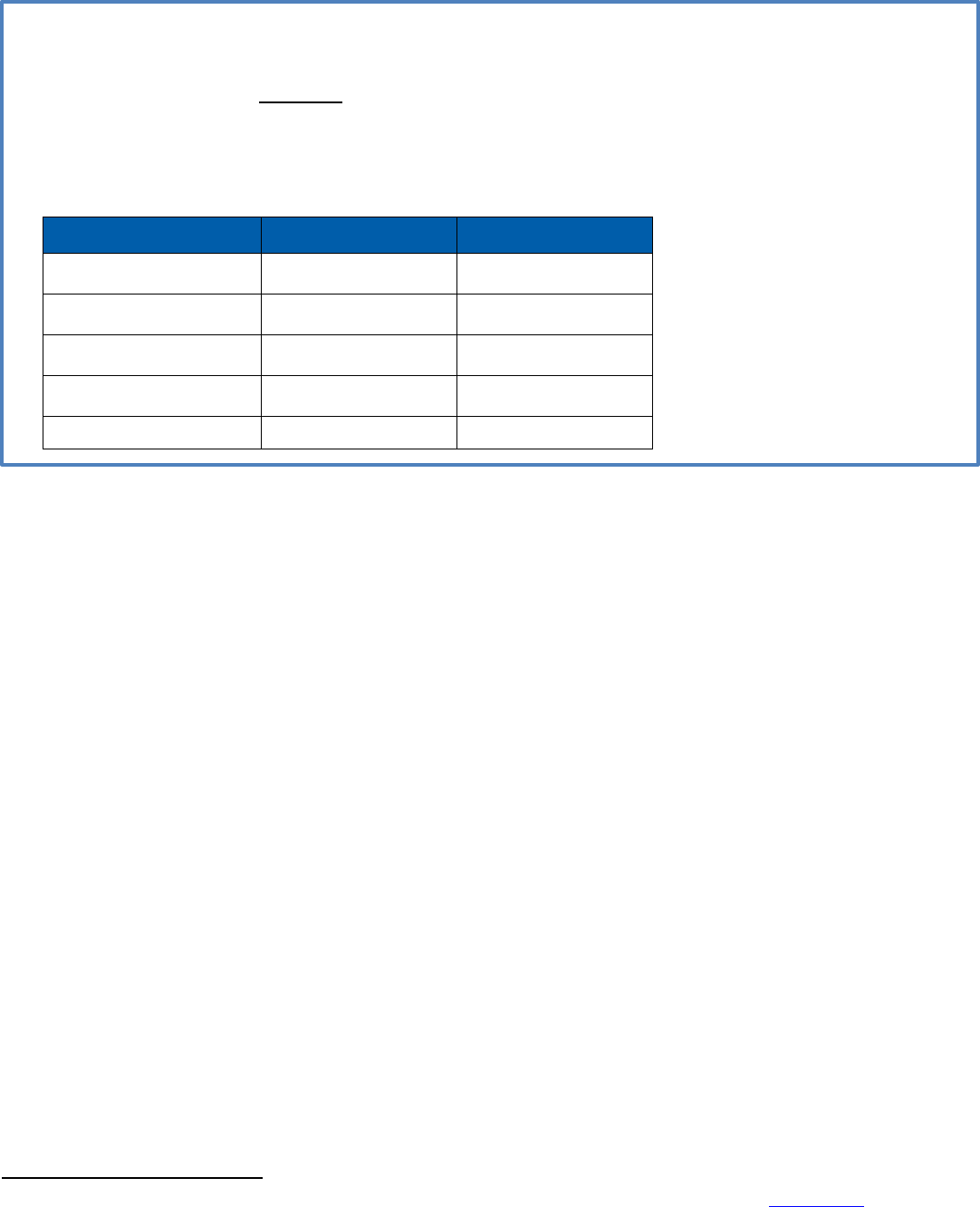

Sample Budget

Fringe benefits are computed by an established rate (Fringe Benefit rate = 25% of total salaries).

Fringe Benefits Total $

If fringe benefits are not calculated using a percentage of salaries, itemize how the amount is determined for each salary

and wage being requested.

Project Coordinator Salary - $45,000

Fringe Benefit Percentage of Salary Amount Requested

Retirement

5% $2,250

FICA 7.65% $3,443

Insurance

N/A $2,000

Workers Compensation N/A $0

Fringe Benefits Total $7,693

4

All supporting documentation related to the elements must be maintained by the recipient and made available upon

request.

Equipment

Equipment is defined as tangible, non-expendable personal property (including exempt property) that has a useful

life of more than one year and an acquisition cost of $5,000 or more per unit. However, if your organization has a lower

threshold, work with your CDC Grants Management Officer to establish a threshold that is consistent with your

organization’s policy.

All budget requests should individually list each item requested and provide the following information: 1) quantity

needed; 2) unit cost of each item; 3) total amount requested; and 4) to the extent possible, the make and model of

the equipment. Also, provide a justification for the use of each item to explain the need and basis for the cost (e.g.,

competitive bidding, and historical cost data compiled by the organization), and relate it to the specific program objectives.

Equipment maintenance or rental fees should be included in the Other category. If available, include documentation for

equipment costs such as invoice, estimate, price quote, or bid sheet.

Supplies

Individually list each item requested and provide the following information: 1) the item requested and type or make and

model; 2) number needed; 3) unit cost of each item; and 4) total amount requested. If appropriate, general office supplies

may be shown by an estimated amount per month times the number of months in the budget category. Also, provide a

justification for the use of each item to explain the need and basis for the cost, and relate it to the specific program

objectives.

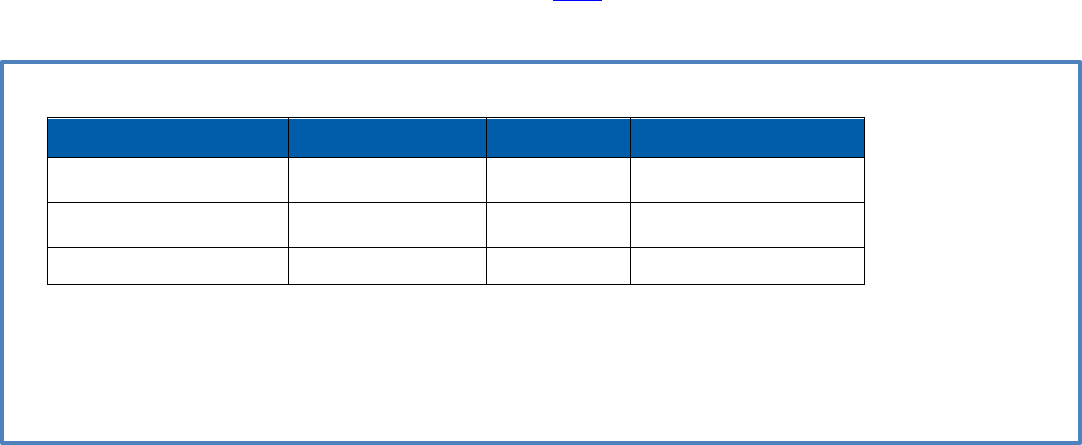

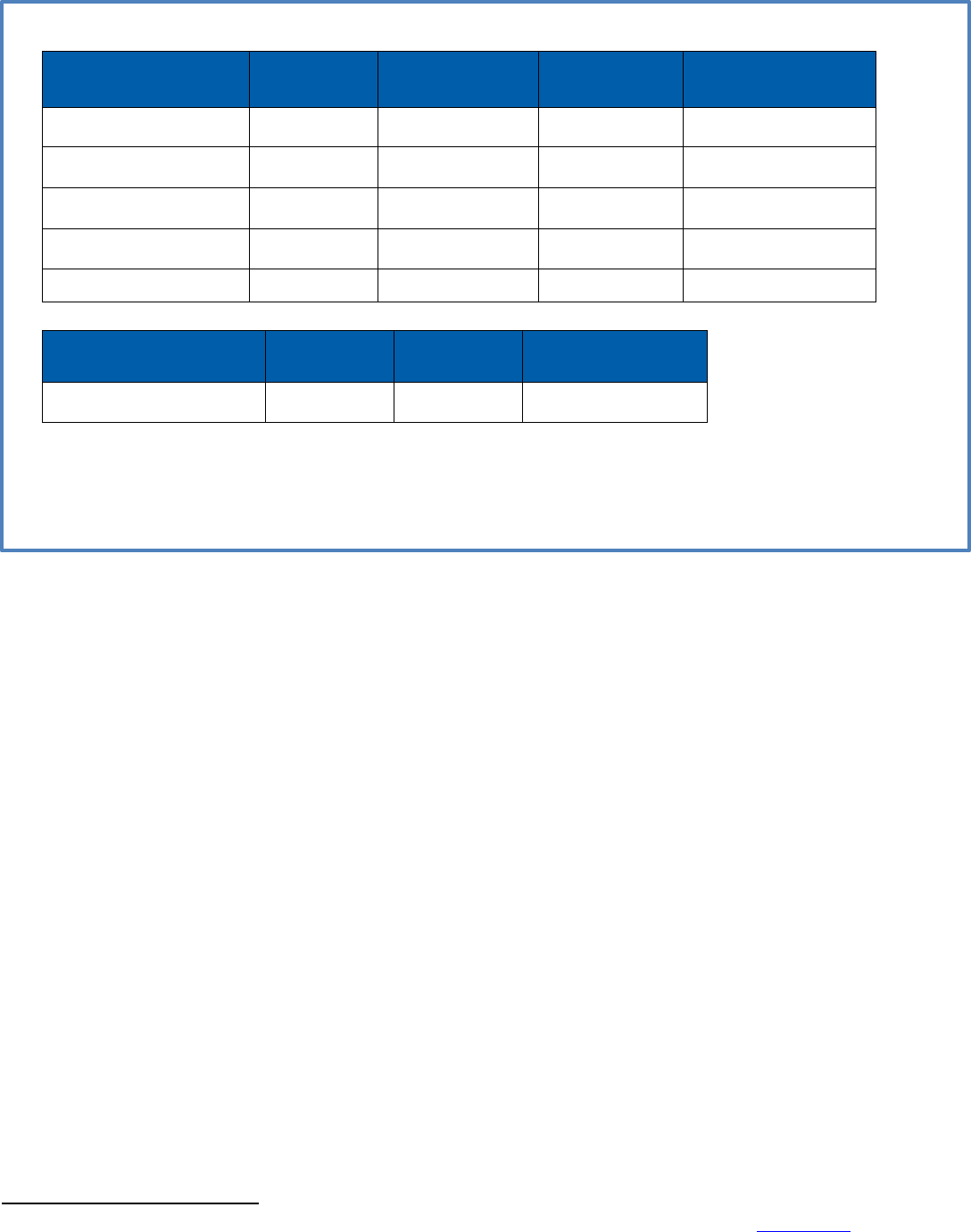

Sample Budget

Item Requested Quantity Needed Unit Cost Amount Requested

Computer Workstation

2 ea. $5,500 $11,000

Computer

1 ea. $6,000 $6,000

Total Equipment Cost $17,000

Sample Justification

The principal investigator and statistician will use the computer workstations to collect required data, perform data

analysis, and generate reports. These computers will also support the daily operation of the project, routine

correspondence, research, and electronic communication. The unit cost estimate is based on historical cost data.

5

Travel

Dollars requested in the travel category should be for recipient staff travel only. Travel for consultants should be shown in

the Consultant category. Travel for other participants (e.g., advisory committees and review panels) should be itemized as

specified below and placed on the Other category.

For Travel, provide a narrative justification describing what the travel staff members will perform. List where travel will be

undertaken, number of trips planned, who will be making the trips, and include the approximate dates. If mileage is to be

paid, provide the number of miles and the cost per mile. If travel is by air, provide the estimated cost of airfare. If per

diem/lodging is to be paid, indicate the number of days and amount of daily per diem, as well as the number of nights and

estimated cost of lodging. Include the cost of ground transportation, when applicable. Include CDC meetings, conferences,

and workshops, if required by CDC.

Note: Local travel is travel within 50 miles (using the most direct route) of both the traveler’s residence and the primary place

of work or permanent duty station (PDS). Only mileage/transportation costs may be charged for local travel. Per diem and

other costs are not allowable for local travel.

Sample Budget

Item Requested Type

Number Needed Unit Cost

Amount Requested

Computer Workstation

(Specify type)

3 ea.

$2,500

$7,500

Software

(Specify type)

1 ea. $400 $400

Educational Pamphlets

N/A

3,000 copies $1 $3,000

General Office Supplies Pens, pencils, paper 12 months

$20/month per

person for 10 people

$2,400

Total Supplies $13,300

Sample Justification

Program staff will use Computer Workstation to develop promotional materials, publications, and progress reports.

Software will be used to develop promotional materials and publications. Educational pamphlets will be purchased and

used to illustrate and promote safe and healthy activities. Staff members will use office supplies to carry out daily

activities of the program. The vendor provided the cost estimates.

6

Other

This category should include expenditures that do not fit within the other cost categories (e.g., registration costs). Individually

list each item requested and provide proper justification related to the program objectives.

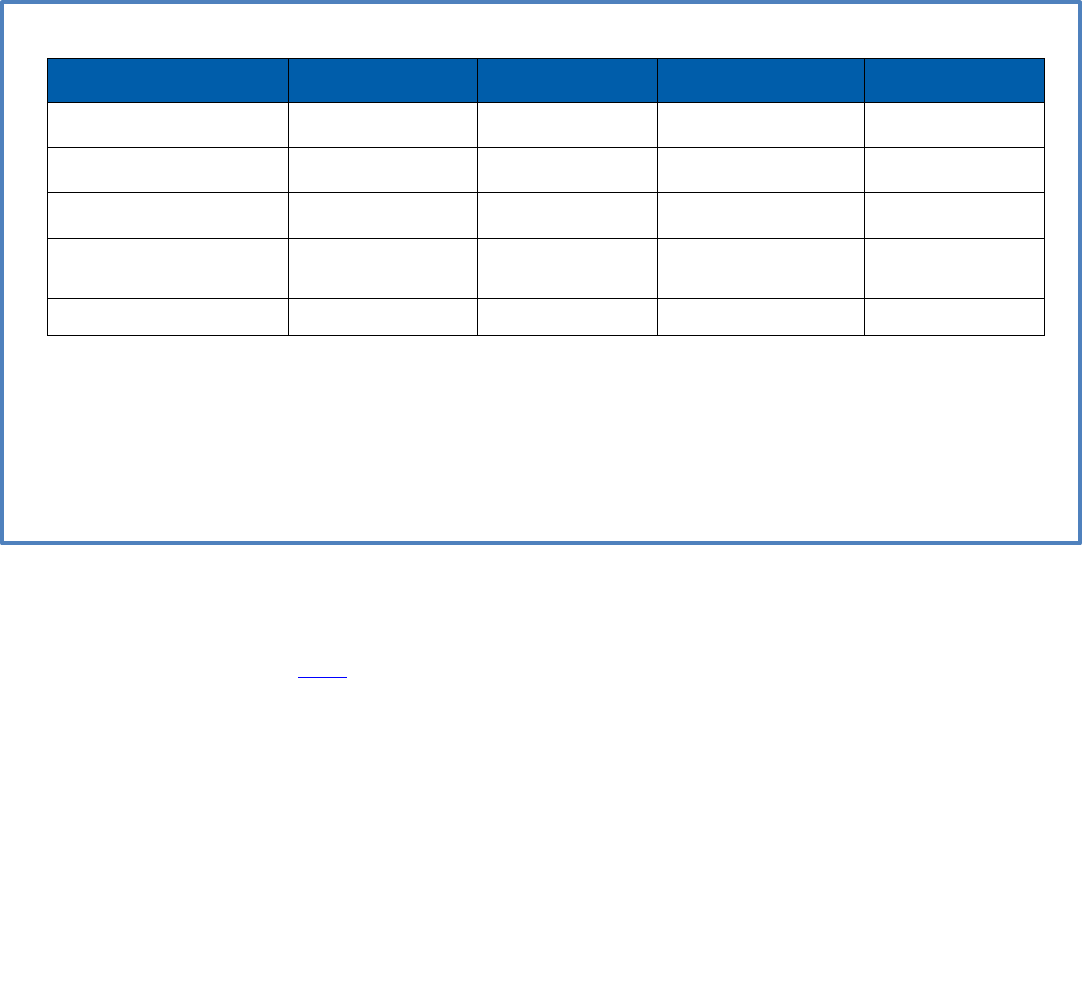

Sample Budget

Travel Total $

Location Number

of Trips

Number of

People

Cost of

Airfare

Number of

Total Miles

per Trip

Cost

per Mile

Amount

Requested

Location Name

1 2 N/A 500 mi. $0.625

$625

Various 25 1 N/A 300 mi. $0.625 $4,687

Total $5,312

Per Diem Number

of People

Number of

Units

Unit Cost Amount

Requested

Meals & Incidentals (M&IE) 2 2 days $59/day $236

Lodging 2

1 night $98/night $196

Total $432

Sample Justification

The Project Coordinator and the Outreach Supervisor will travel to (insert location name) to attend the AIDS conference.

The Project Coordinator will make an estimated 25 trips to an outreach site to monitor program implementation. Cost

estimates are based on the organizational travel policy.

7

Contractual Costs

Recipients must receive the NOA reflecting CDC approval of this cost prior to establishing a third-party contract to perform

program activities. Approval must be obtained for each budget period to reestablish the written agreement. The budget

request should include a summary of the proposed contractual request and cost for each contract proposed detailing the six

elements below.

1. Period of Performance: Specify the beginning and ending dates of the contract.

2. Scope of Work: Describe the specific services/tasks to be performed by the contractor and relate them to the

accomplishment of program objectives. Deliverables should be clearly defined. Copies of the actual contract

should not be sent to CDC, unless specifically requested.

3. Itemized Budget and Justification: Provide and itemized budget with proper justification. If applicable, include

any indirect cost paid under the contract and the indirect cost rate used.

4. Name of Contractor: Identify the name of the proposed contractor and indicate whether the contract is with an

institution or organization.

5. Method of Selection: State whether the contract is sole source or competitive bid. If an organization is the sole

source for the contract, include an explanation as to why this institution is the only one able to perform contract

services.

6. Method of Accountability: Describe how the progress and performance of the contactor will be monitored. Identify

who will be responsible for supervising the contract.

Elements 1-3 are required for approval of contract budget cost requests. If these elements are not known at the time the

application is submitted, the cost will not be approved and the recipient may submit these details as a prior approval

request.

7

If elements 4-6 are not available at the time of application, recipients may submit the remaining details as they

become available via GrantSolutions Grants Management Services (GSGMS) Grant Notes for non-research and via email to

the assigned Grants Management Specialist (GMS) and Scientific Project Officer/Project Officer (SPO/PO) for research.

7

For more information about prior approval requests, please review the prior approval guidance on the CDC website.

Sample Budget

Item Requested Number of

Months

Estimated Cost

per Month

Number of Staff Amount Requested

Telephone

12 $45 8

$4,320

Postage

$ N/A

$

Equipment Rental

$

N/A $

Internet Provider Service

$

N/A $

Total Other

$4,320

Item Requested Number

Needed

Unit Cost Amount Requested

Printing

__ documents $ $

Sample Justification

For printing costs, identify the types of documents (e.g., procedure manuals, annual reports, and materials for media

campaign) and number of copies to be printed.

Supporting documentation related to all contractual elements must be maintained by the recipient and made available

upon request.

Indirect (Facilities and Administrative-F&A) Costs

Some applicants/recipients include indirect costs in their budget requests. To include indirect costs, the applicant organization

must have a current approved indirect cost rate agreement established with the HHS Cost Allocation Services (CAS) office, or

the entity’s cognizant federal agency.

8

A copy of the most recent indirect cost rate agreement or a cost allocation plan must

be provided with the application. Alternatively, the following specific types of entities and programs have other options which

may be allowable for indirect costs.

States and Local Government and Indian Tribe:

• Applicants/recipients (domestic governmental entities) that receive less than $35 million in direct federal funding

may use an indirect cost proposal. The indirect cost proposal must be developed per the requirements of 45 CFR

75 and the recipient must maintain the proposal and related supporting documentation for audit. These entities

are not required to submit their proposals unless they are specifically requested to do so by the cognizant agency

for indirect costs. A local jurisdiction may use the indirect cost proposal that is approved by the state.

• Each Indian tribal government desiring reimbursement of indirect costs must submit its indirect cost proposal to

the Department of the Interior (its cognizant agency for indirect costs).

Foreign Organizations:

• Indirect costs at a rate of 8 percent of modified total direct costs (MTDC), excluding tuition and fees, direct

expenditures for equipment, and subawards and contracts more than $25,000, may be provided to foreign and

international organizations to support the costs of compliance with federal requirements.

o Compliance requirement examples include, but may not be limited to, protection of human subjects, animal

welfare, research misconduct, invention reporting, and other post-award reporting requirements.

Training Grant Programs:

• Indirect costs on training grant programs are limited by HHS policy to a fixed rate of 8 percent of modified total

direct costs (MTDC) excluding tuition and related fees, direct expenditures for equipment, and subawards and

contracts more than $25,000.

If the applicant organization or recipient does not have an approved indirect cost rate agreement or is not one of the

specific entities or programs outlined above, costs normally identified as indirect costs (overhead costs) can be budgeted

and identified as direct costs. Applicants/recipients (other than government units) that have never received a federally

negotiated indirect cost rate may elect to budget for a de minimis rate of 10% of modified total direct costs. The de

minimis rate may be used indefinitely. Once a recipient chooses the de minimis rate, it must be used consistently across

all federal awards until the recipient decides to negotiate for a rate with the cognizant federal agency.

8

The cognizant federal agency for indirect cost rate negotiation is typically the agency which provides the preponderance of funding.